Working capital financing policies are crucial for businesses to manage their short-term financial needs effectively. These policies dictate how a company funds its day-to-day operations and ensures it has enough cash flow to cover expenses. By understanding the different types of working capital financing policies, businesses can make informed decisions to optimize their financial health. Join us as we explore the details of these policies, revealing practical advice to improve your financial well-being and promote sustainable growth.

Understanding Working Capital Financing

Businesses need working capital financing programs to handle their short-term financial needs well. These rules tell a business how to use working capital to pay for daily costs and make sure it has enough cash flow to satisfy its bills. Businesses can make smart choices to improve their financial health by learning about the three policies for working capital finance.

Let’s look at how alternative ways of getting working capital can help your finances and support long-term growth.

What is Working Capital Financing?

Financing working capital is like the gas that keeps a business running smoothly. It helps pay for short-term costs like salaries, rent, or buying raw materials. In short, working capital finance keeps the business running smoothly without any cash flow problems.

There are various working capital funding methods like short-term loans, invoice discounting, and lines of credit. Choosing the right option depends on the company’s size, industry, and immediate funding needs. The aim is to maintain a healthy cash position while avoiding excessive borrowing costs.

Types of Working Capital Financing Policies

In financial management, there are 3 types of working capital financing policy:

Conservative Financing Policy

Safety and financial stability are given the highest priority by this policy. When businesses take this method, they ensure that they have sufficient cash reserves and steer clear of excessive debt, which enables them to fulfill their expenses even when times are difficult. However, it may slow down growth and limit prospects for expansion, despite the fact that it decreases risk.

Aggressive Financing Policy

On the flip side, an aggressive policy is all about chasing growth. Companies following this approach are willing to take on more debt to finance big projects or seize opportunities for rapid expansion. They prioritize growth over stability, aiming to maximize returns even if it means taking on more risk. While this strategy can lead to faster growth, it also comes with greater financial risk.Moderate Financing Policy: As the name suggests, a moderate policy strikes a balance between conservatism and aggression. Companies following this approach aim to grow steadily without taking on too much risk. They carefully manage their debt levels and invest in growth opportunities in a controlled manner. While this strategy may not lead to rapid growth, it offers a more stable and sustainable approach to financing.

Matching (or Hedging) Policy

This plan uses short-term loans to pay for short-term assets and long-term loans to pay for long-term assets. It helps keep a balance between liquidity and profitability by providing a steady middle ground between aggressive and conservative practices.

Factors Influencing the Choice of Financing Policy

- Financial Situation: One of the biggest factors is the company’s financial health. If a company has a lot of cash on hand and strong profits, it might feel comfortable taking on more debt to finance growth. But if it’s struggling financially, it may need to be more conservative and focus on paying off existing debt.

- Industry Norms: Capital-intensive sectors may require higher upfront working capital financing.

- Growth Opportunities: Companies with big growth opportunities may be more willing to take on debt to finance expansion projects or acquisitions. They see the potential for high returns and are willing to accept more risk in pursuit of those opportunities.

- Risk Tolerance: Every company has a different appetite for risk. Some are comfortable taking on a lot of debt to fund growth, while others prefer to play it safe and avoid taking on too much risk. This risk tolerance will influence the choice of financing policy.

- Regulatory Environment: Government regulations can also impact financing decisions. For example, certain industries such as banking and healthcare often face stricter borrowing regulations while sectors like renewable energy might have access to special financing programs and incentives.

- Market Conditions: Economic conditions and market trends can also play a role. In a strong economy with low interest rates, companies may be more willing to borrow money. But in a recession or when interest rates are high, they may be more cautious.

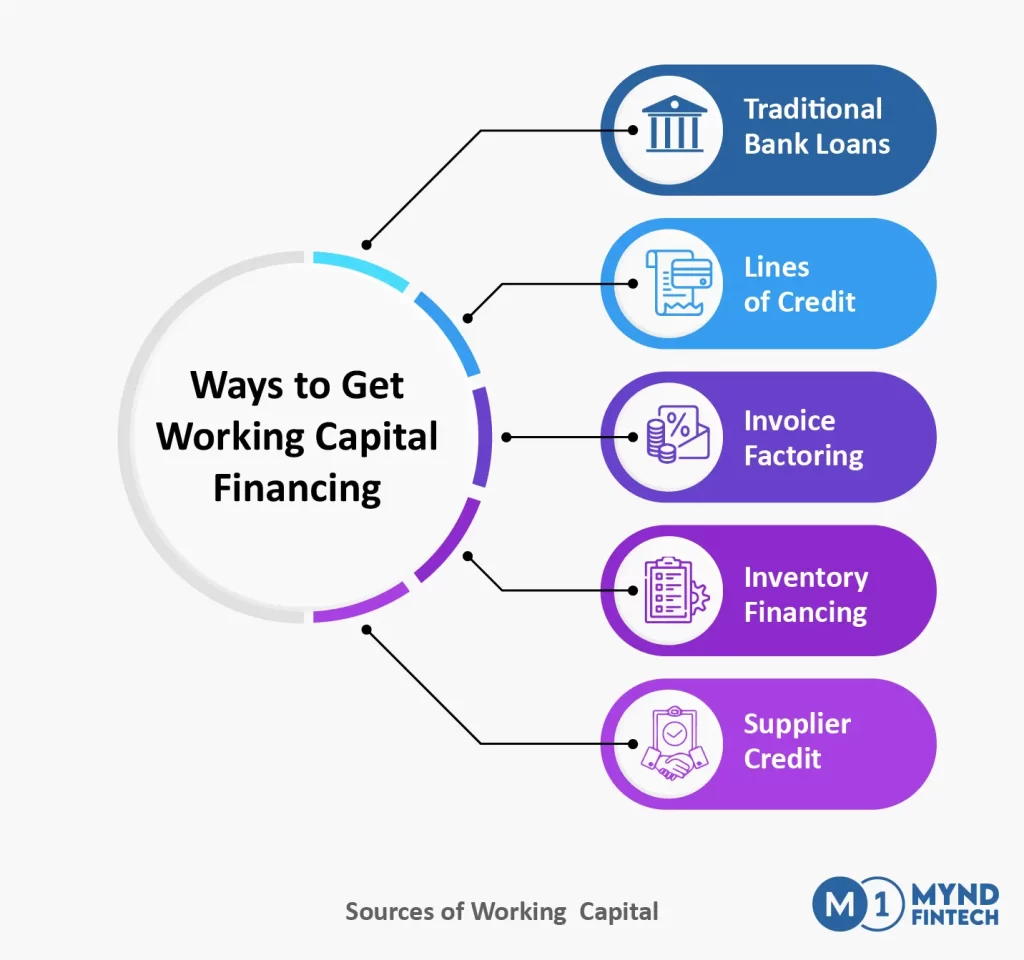

Ways to Get Working Capital Financing

- Traditional Bank Loans: One common way to get business cash flow solution is through traditional bank loans. Businesses can apply for a loan from a bank, and if approved, receive a lump sum of money which they repay over time with interest. These loans may require collateral, such as business assets or personal guarantees, to secure the funding.

- Lines of Credit: Another option is to secure a line of credit from a bank or financial institution. A line of credit gives businesses access to a predetermined amount of money that they can borrow as needed. They only pay interest on the amount they borrow, and once repaid, the funds become available again for future use.

- Invoice Factoring: Invoice factoring involves selling accounts receivable to a third-party company, known as a factor, at a discount. The factor advances a percentage of the invoice value upfront and collects payment from customers on behalf of the business. This provides businesses with immediate cash flow to cover expenses while waiting for customers to pay their invoices.

- Inventory Financing: Businesses with substantial inventory can use inventory financing to obtain working capital. This involves using inventory as collateral to secure a loan or line of credit. Lenders may advance funds based on the value of the inventory, allowing businesses to free up cash tied up in inventory to cover other expenses.

- Supplier Credit: Also called trade credit, this type of financing enables firms wait to pay their suppliers (for example, 30 to 90 days), which helps them keep cash flow for other working capital needs. It’s a good approach to keep cash flow and handle short-term concerns.

Benefits of Working Capital Financing

Smooth Cash Flow

Working capital financing ensures that businesses have enough cash on hand to cover day-to-day expenses like payroll, inventory purchases, and utility bills. This helps smooth out cash flow fluctuations and prevents disruptions in operations.

Supports Growth

By providing access to additional funds, working capital financing supports business growth initiatives such as expanding operations, launching new products or services, or entering new markets. It gives businesses the flexibility to seize growth opportunities as they arise.

Manages Seasonal Fluctuations

Many businesses experience seasonal fluctuations in demand or revenue. Working capital financing helps businesses manage these fluctuations by providing the necessary funds to cover expenses during slow periods and capitalize on opportunities during peak seasons.

How Mynd Fintech provides Financing

Mynd Fintech provides financing through a digital lending marketplace focused on enabling supply chain finance solutions. Acting as a bridge between anchor corporations, vendors, dealers, buyers, and banks/NBFCs. It offers various solutions like vendor finance, dealer finance, factoring, sales invoice finance, dynamic discounting, and purchase invoice discounting, empowering MSMEs with easy and quick funding via multiple lending partners. Mynd Fintech offers accessible and tailored financing options, supporting businesses in managing their working capital needs and driving growth in the dynamic marketplace.

Conclusion

Working capital financing policies play a critical role in shaping a company’s financial health and growth trajectory. By understanding the characteristics and implications of conservative, aggressive, and moderate policies, businesses can make informed decisions to optimize their working capital management.

FAQs

Q1. How does Mynd Fintech support working capital needs?

Ans. Mynd Fintech supports working capital needs through a digital lending marketplace that connects businesses with multiple banks and NBFCs. It offers solutions such as vendor finance, dealer finance, invoice factoring, and purchase invoice discounting. These flexible, tech-enabled offerings ensure quick access to funds, reduce reliance on traditional loans, and help businesses manage cash flow more efficiently in their supply chain ecosystem.

Q2. Which financing policy is best for startups?

Ans. Startups typically benefit from either an aggressive or a moderate working capital financing policy. An aggressive policy allows them to fuel fast growth using short-term debt, while a moderate approach offers a balance of risk and stability. The best choice depends on the startup’s current cash flow, scalability potential, risk appetite, and how quickly they plan to grow or scale operations.

Q3. Why is working capital funding important?

Ans. Working capital funding is essential because it ensures a business can meet its daily operational expenses without interruption. It supports smooth cash flow, helps manage seasonal revenue fluctuations, and allows businesses to seize new opportunities or respond to unexpected challenges. Without sufficient working capital financing, companies may face delays in operations, missed growth opportunities, or payment defaults.

Q4. How do businesses choose the right working capital financing policy?

Ans. Choosing the right working capital financing policy depends on multiple factors, including the company’s current financial health, industry norms, growth objectives, and risk appetite. Businesses also evaluate their operating cycle, cash flow predictability, and prevailing market or interest rate conditions. A balanced assessment of these elements helps determine whether a conservative, aggressive, or moderate policy is most suitable.

Q5. How does supplier credit help in working capital management?

Ans. Supplier credit, also known as trade credit, allows businesses to delay payments to suppliers while immediately using the goods or services received. This helps preserve cash for other operational needs, improving liquidity without incurring interest costs. It’s a strategic and cost-effective tool in working capital management, especially useful during short-term cash flow gaps or seasonal financial crunches.

Q6. What are the types of working capital financing policies?

Ans. There are three main types: Conservative, Aggressive, and Moderate. Conservative policy focuses on financial safety with lower risk and more equity use. An aggressive policy relies more on short-term debt for higher returns. Moderate policy balances both approaches to ensure steady growth while maintaining acceptable risk levels and liquidity.

Q7. How does working capital financing help businesses?

Ans. Working capital financing helps businesses maintain steady cash flow, meet short-term liabilities, and avoid operational disruptions. It supports day-to-day expenses like salaries, rent, and raw material purchases. It’s especially beneficial during seasonal sales fluctuations or cash flow gaps, helping businesses run efficiently and take advantage of growth opportunities.

Q8. Which working capital policy suits growing businesses?

Ans. Rapidly growing businesses may prefer an aggressive policy to capitalize on expansion opportunities, even if it involves higher financial risk. However, those looking for stability with growth might adopt a moderate approach. The choice depends on available cash flow, market conditions, and how much risk the business is willing to take.