Have you ever wondered why two companies in the same industry might have vastly different working capital needs? Imagine two retail businesses side by side; one easily manages cash flows with minimal stress, while the other constantly struggles to pay suppliers on time. This difference often boils down to understanding and managing the factors affecting working capital requirements.

In simple terms, working capital is the money available for your day-to-day operations, ensuring your business runs smoothly without hiccups. Managing it effectively is essential because it directly impacts your company’s liquidity, flexibility, and overall financial health. So, let’s dive into the key factors that influence working capital and help your business stay financially agile.

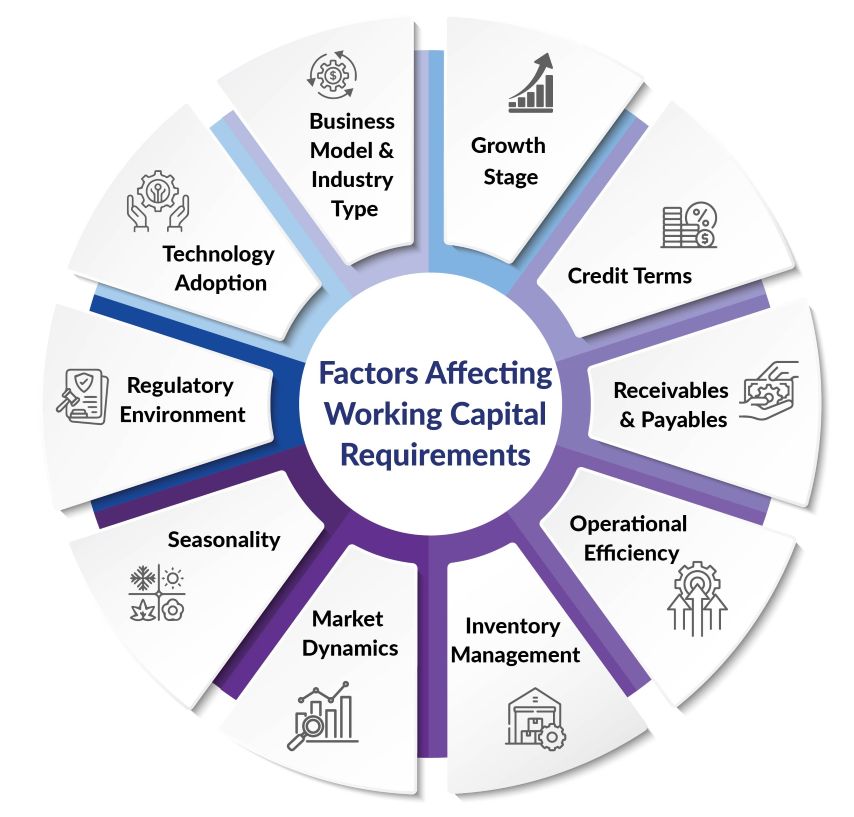

Factors Affecting Working Capital Requirements:

Factors Affecting Working Capital Requirements:

1. Business Model, Industry Type, and Growth Stage

Business Model

Your operating model directly affects working capital needs. Product-based businesses generally require more capital due to inventory and logistics, while service-based businesses typically need less as they operate with fewer physical assets.

Industry Type

Different industries have different capital intensity. Manufacturing and construction often require higher working capital due to bulk procurement and longer operating cycles, whereas industries like IT or consulting may operate with minimal ongoing capital needs.

Growth Stage

As a company scales, its working capital requirements increase. Rapid expansion, new product development, or entering new markets can stretch resources. The working capital requirement of the firm depends on how aggressively it is growing and investing in operations.

2. Credit Terms, Receivables and Payables

Your credit terms- how quickly you collect money from your customers and how long you take to pay your suppliers can drastically influence your working capital requirements. Think of it as balancing scales; if you’re giving customers generous payment terms but your suppliers demand quick payments, your cash flow can become strained.

Efficient management of receivables and payables is one of the key factors determining the working capital requirements. To maintain optimal liquidity, businesses often negotiate favourable terms with suppliers while also streamlining collections from customers. Smart credit policies, prompt invoicing, and proactive collections strategies can significantly ease cash flow pressures and keep your business operations running seamlessly.

3. Operational Efficiency and Inventory Management

Efficient operations aren’t just good practice; they’re crucial in managing your working capital. One of the most important factors affecting working capital management is how quickly your inventory moves from procurement to sale. Companies with rapid inventory turnover tie up less cash, freeing resources for other critical business activities.

Adopting smarter inventory practices like just-in-time (JIT) inventory management or lean manufacturing processes can drastically reduce unnecessary stockpiling. Additionally, integrating digital tools and automation into your operational workflows can improve forecasting accuracy, reduce waste, and ensure that you have just the right amount of stock on hand. Better efficiency not only optimizes your working capital but also directly boosts your profitability. For a deeper look into how streamlining each stage of your cycle can improve results, explore our article on mastering the working capital cycle.

4. External Factors: Market Dynamics, Seasonality and Regulatory Environment

Businesses don’t operate in isolation. External factors such as market conditions, seasonality, and regulatory changes significantly influence the amount of working capital your company needs.

Seasonality

In industries like retail, hospitality, or agriculture, specific periods of the year bring spikes in demand, resulting in higher inventory and staffing needs. During off-seasons, managing cash flow becomes crucial, requiring careful forecasting and planning.

Market Dynamics

Broader market dynamics play a critical role. Economic downturns, inflation, or even global supply chain disruptions can dramatically alter your working capital needs almost overnight. Navigating these uncertainties requires companies to maintain flexible cash reserves and contingency plans.

Regulatory Environments

Shifts in taxes, changing interest rates, and compliance costs are critical external factors affecting working capital requirements. A sudden tax hike or new regulatory compliance measure can quickly elevate your cash demands. Staying informed and agile ensures your company remains stable and resilient, even amidst changing external conditions.

5. Leveraging Technology for Working Capital Optimization

Technology isn’t just about efficiency; it’s also about gaining greater visibility into your financial health. Digital tools have increasingly become indispensable in helping businesses optimize their working capital management. For instance, automating invoice processing, payment schedules, and inventory tracking significantly reduces manual effort and errors, directly affecting cash flow positively.

This is precisely where specialized fintech solutions, such as those provided by Mynd Fintech, can come into play. Their services, including automated invoice processing, , real-time insights and streamlined workflows. By leveraging such solutions, companies can effectively manage the core factors affecting working capital management, ensuring more accurate forecasting, efficient use of resources, and ultimately healthier financial operations.

Conclusion

Understanding and managing working capital isn’t merely an accounting exercise; it’s a strategic necessity. Each factor, from your business model to market conditions and operational efficiency, plays a critical role in shaping your company’s liquidity. Regularly reviewing these factors determining the working capital requirements will equip you to make smarter decisions and proactively address financial challenges before they escalate.

By combining strategic planning, effective policies, and the right technology, your business maintains adequate working capital, paving the way for sustainable growth and operational resilience.

FAQs

Q1. How does inventory turnover affect working capital?

Ans. Faster inventory turnover reduces the amount of cash tied up in stock, allowing more liquidity for other operations. It leads to lower holding costs and tighter working capital cycles, which is especially beneficial for businesses with fluctuating demand.

Q2. Can seasonal businesses manage working capital without external funding?

Ans. Yes, with careful planning. Seasonal businesses can use strategies like pre-season cash flow forecasting, negotiating extended vendor terms, and adjusting operating expenses in off-peak periods. Building cash reserves during peak months can reduce dependence on short-term loans.

Q3. How can technology help in working capital optimization?

Ans. Technology plays a major role by automating manual processes, improving invoice turnaround time, and offering real-time insights into receivables, payables, and cash positions. This enables faster decisions and better control over short-term liquidity.

Q4. Are there industry benchmarks for working capital ratios?

Ans. Yes, but they vary by industry. For example, manufacturing firms often have higher working capital needs due to inventory-heavy operations, while service-based companies may operate with minimal working capital. Comparing your ratios to industry standards helps identify whether your business is over- or under-leveraging its capital.

Q5. What internal policies can strengthen working capital management?

Ans. Implementing strict credit control policies, setting clear payment terms, incentivizing early customer payments, and monitoring overdue accounts regularly can significantly improve working capital efficiency.

Q6. How do mergers or acquisitions impact working capital?

Ans. During mergers or acquisitions, integration of systems, supply chains, and payment cycles can create temporary mismatches in cash flow. It’s important to reassess working capital needs during these transitions to avoid operational disruptions.