In businesses, customers frequently delay their payments even after their due date, and without sufficient working capital, it becomes very difficult for the seller to accept their next order. Furthermore, if the seller continually gets on the customer’s nose to make the payment as quickly as possible, it creates the possibility of losing the customer.

To address this problem, Mynd Fintech assists vendors and major businesses in utilizing bill or invoice discounting, which is a sort of prepayment of dues in exchange for funds that are projected to arrive soon. Mynd Fintech’s Purchase Bill Discounting service factors clients’ purchase bills and makes payments to their suppliers on their behalf. In layman’s terms, it helps in providing financing against your purchases.

What is Purchase Bill Discounting?

The terms “invoice discounting”, “bill discounting“, and “purchase of bills” are all synonyms for ‘Purchase Bill Discounting’. For the seller of goods on credit, invoice discounting acts as a source of finance. It is a method of recovering a portion of a sales bill from financial intermediaries such as banks, financial institutions, NBFCs, etc. Before it becomes due & for their services, such intermediaries charge a fee. The fee will be determined by the amount of time left before the payment deadline, as well as the perceived risk. Bill discounting Invoices or invoices are legally referred to as “bills of exchange.”

A bill of exchange is a negotiable instrument that can be exchanged simply by signing the name.

Difference between Purchase Bill Discounting & Sales Bill Discounting

Purchase Bill Discounting

A financing method where a buyer secures funds by discounting the purchase bill (invoice) issued by their supplier. It helps buyers make early payments to suppliers and allows the buyer to manage working capital efficiently and maintain supplier relationships by ensuring timely payments.

Process:

- The buyer requests the financial institution to pay the supplier on their behalf before the due date.

- The financial institution pays the supplier and collects the payment from the buyer on the due date

Sales Bill Discounting

A financing method where a seller obtains funds by discounting the sales bill (invoice) they have issued to a buyer. It helps sellers receive immediate cash for goods or services sold and provides sellers with quick liquidity to meet operational expenses or reinvest in the business.

Process:

- The seller submits the sales invoice to the financial institution.

- The financial institution pays the seller immediately, deducting a discounting fee.

The financial institution collects the payment from the buyer on the invoice due date

Purchase Bill Discounting Eligibility Criteria?

Purchase Bill Discounting Eligibility Criteria:

- The contract, as well as the payment, must be documented in writing and signed by both parties (the company and the customer).

- The concerned clients must place a sales order.

- The customer must issue an invoice for the specific payment that is outstanding.

- It is necessary to specify the exact date on which the unpaid payment is due.

Documents required for Purchase Bill Discounting?

- Bill of Exchange

- Commercial Invoice and Packing List

- Transport Document i.e. (e-way bill)

- Delivery Challan, if any

- Acceptance from the line of credit-issuing Bank

- Discounting request letter

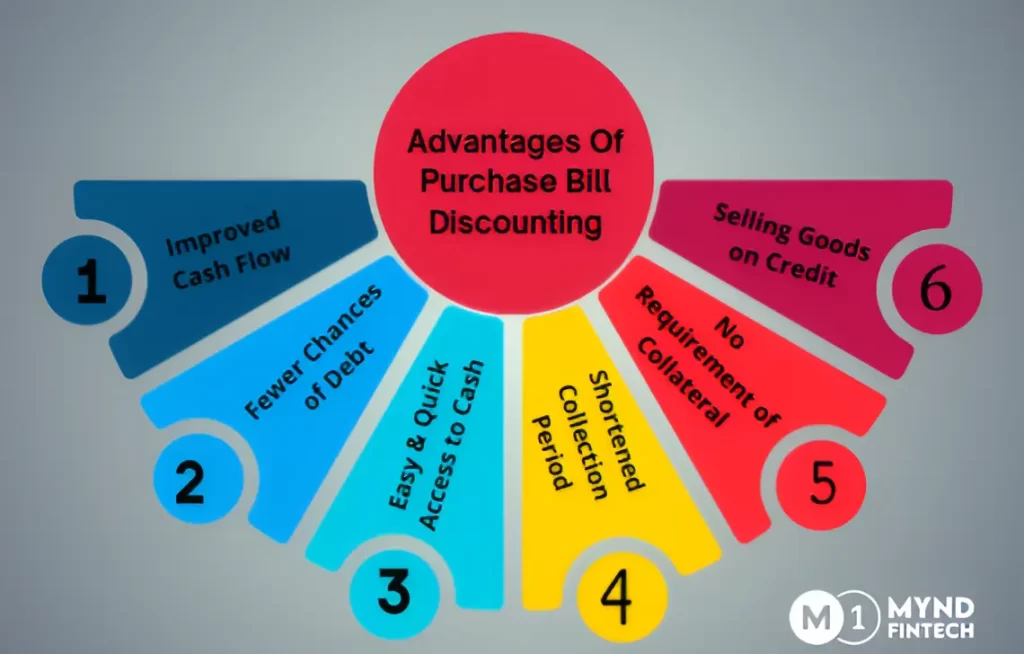

Advantages of Purchase Bill Discounting:

- Improved cash flow: If you’re getting numerous new projects at the same time and your previous invoice payment hasn’t arrived, you’ll need immediate funds to work on those new projects, then bill discounting will be your only option. It helps your cash flow by providing capital quickly.

- Fewer chances of debt: Because the company only pays a portion of its profits, there is less risk of big losses or having to borrow money to cover such losses. The businessman can easily obtain cash by releasing money that has been trapped in the shape of overdue bills.

- Easy & quick access to cash: Invoice discounting gives liquid cash to businesses as soon as an invoice is issued which is faster than alternative credit options. It helps the borrower spend money on the next project, business expansion, or repaying outstanding debts, among other things.

- Shortened collection period: The time it takes from receiving the goods or services to generating the bill, waiting for payment, and finally receiving payment in liquid currency is far too long. Invoice discounting shortens the time it takes to receive money. To be clear, the blocked funds are changed to cash without having to wait for the end of the credit period.

- No requirement of collateral: In most cases, no movable or immovable asset is required as security throughout the discounting procedure. Only the fee that is taken from the total amount due is the expense that the applicant must bear.

- Selling goods on credit: When things are sold on credit, the customer owes money to the supplier of goods and services. If customers prefer credit payment, companies that use invoice discounting can increase sales because they no longer have to wait for actual cash payments and the discounting agencies such as Mynd Fintech will pay them. As a result, they can give their next consumer the same option of paying overtime.

Conclusion

Purchase bill discounting is an excellent strategy to manage your business without risking your relationships. With immediate funding, these short-term loans assist in keeping the firm moving forward. Above all, it creates a win-win situation for all parties involved, including the company, its customers, suppliers, and discounting financial institutions such as Mynd Fintech.

Purchase Bill Discounting FAQs:

1. How do you calculate discounted bills?

Ans: Discounting charges refer to the fees or amount deducted by the bank or discounting agencies as their commission from the amount of the bill receivable discounted by the bank or agency. It is computed by multiplying the rate of discount by the unexpired term, which is the time remaining before maturity.

Amount of Bill Discounted ×Rate × Unexpired Period = Discounting Charges

2. Is GST applicable on bill discounting?

Ans: No, GST is not applicable on bill discounting because it is similar to giving a credit facility or a loan.

3. Is there a discount before or after-tax?

Ans: A discount, even if not stated on the invoice, can be deducted from the taxable value, if the following requirements are met:

- Before supply, a discount is set under the terms of an agreement. In other words, both the supplier and the recipient are aware of the discount and have agreed to it.

- A discount is tied to a specific supply invoice.

- The buyer or recipient of the supply must reverse the input tax credit related to the discount.

4. What is the difference between discounting and negotiation?

Ans: Negotiation of documents suggests that a bank has paid the amount on any day previous to the bill’s due date under the letter of credit (LC). The drawer of the bill is a source of recourse for a negotiating bank.

The term “discounting” refers to the practice of prepaying a future-due utility bill after deducting interest up to the due date. Discounting is typically done under the terms of a facility agreement, which grants the lending institution recourse against the drawer.

Both LC and non-LC bills are eligible for discounts. Only bills with LC open for negotiation can be negotiated.