At first glance, negative working capital might seem like a financial red flag. After all, it means a company’s current liabilities exceed its current assets, which sounds like a liquidity problem.

But the reality isn’t always so simple. In some industries, negative working capital is not only normal but can also be a sign of strong operational efficiency. Businesses that turn over inventory quickly, collect payments faster than they pay suppliers, or operate with minimal capital tied up in assets can function effectively with negative working capital.

To understand its real impact, we first need to look at what negative working capital actually means, how it works across different business models, and when it becomes a concern.

What Is Negative Working Capital and How Does It Work?

Working capital is calculated by subtracting current liabilities from current assets. When this value is negative, it means the business’s short-term obligations exceed its short-term assets, such as cash, inventory, and receivables.

Negative working capital typically looks like this:

- The company collects payments from customers quickly, boosting cash inflows.

- It delays payments to vendors or suppliers, extending the use of short-term liabilities.

- It carries little inventory or turns it over rapidly, reducing the amount of capital tied up in current assets.

This is common in fast-paced industries like retail, food service, and e-commerce, where cash moves quickly and inventory turnover is high.

Let’s say a retail business collects customer payments immediately but negotiates 60-day payment terms with suppliers. That company technically has negative working capital, but it’s not in trouble. In fact, it may be operating efficiently by using supplier credit to fund its operations.

However, this only works well when:

- Customer demand is consistent

- Supplier relationships are strong

- The business has control over its receivables and payables

What Negative Working Capital Implies About Your Business

So, what does it mean when a business operates with negative working capital? Negative working capital implies that the company is relying more on short-term liabilities to finance its operations than it has in short-term assets This might sound risky, but it can also point to a well-optimized cash cycle.

Here’s what negative working capital implies that you should be aware of:

- Tight cash control: The business may be leveraging quick customer payments to reduce the need for working capital.

- Strong supplier terms: It could have favourable credit terms that allow it to delay payments without penalties.

- Efficient operations: Inventory turns over quickly, so less capital is locked in unsold stock.

However, the same structure can create risk if:

- Customer demand slows down

- Suppliers reduce payment terms

- Receivables start getting delayed

The key is context. A manufacturing company with long production cycles and delayed receivables may struggle with negative working capital, while a grocery chain might thrive on it.

When Does Negative Working Capital Become a Risk?

Negative working capital is not always a red flag, but when it is, the consequences can be serious. If a company consistently has more short-term liabilities than assets without a solid operational reason or financial strategy, it could face real pressure.

Here’s when negative working capital becomes risky:

- Unpredictable cash inflows: If customers delay payments, a company may not have enough to cover its obligations.

- Supplier strain: Vendors may tighten payment terms if they sense financial instability.

- Limited reserves: There’s little buffer for unexpected costs like equipment breakdowns or market disruptions.

- Dependency on credit: Companies may rely on short-term loans just to keep operations running.

In such scenarios, negative working capital creates a cash flow trap that limits flexibility and increases financial stress. To navigate these challenges, businesses often turn to tailored financial tools that bridge short-term liquidity gaps.

This is where companies like Mynd Fintech step in to solve these liquidity challenges head-on. Their offerings, including invoice discounting and vendor finance, help businesses unlock capital tied in receivables, ensuring smoother inflows even if customers delay payment. Dynamic discounting helps buyers support their supply chain by offering early payments in exchange for discounts, reducing supplier strain and strengthening vendor relationships. By bridging cash flow gaps and reducing reliance on short-term loans, Mynd Fintech enables businesses to operate efficiently even in a negative working capital scenario, with greater control, resilience, and flexibility.

How to Manage Negative Working Capital Effectively

Managing negative working capital is all about control. When it’s part of a deliberate strategy, the focus shifts from avoiding it to optimizing it. Businesses that do this well understand their cash cycle inside out and build systems to respond quickly to shifts in demand, expenses, or payment terms.

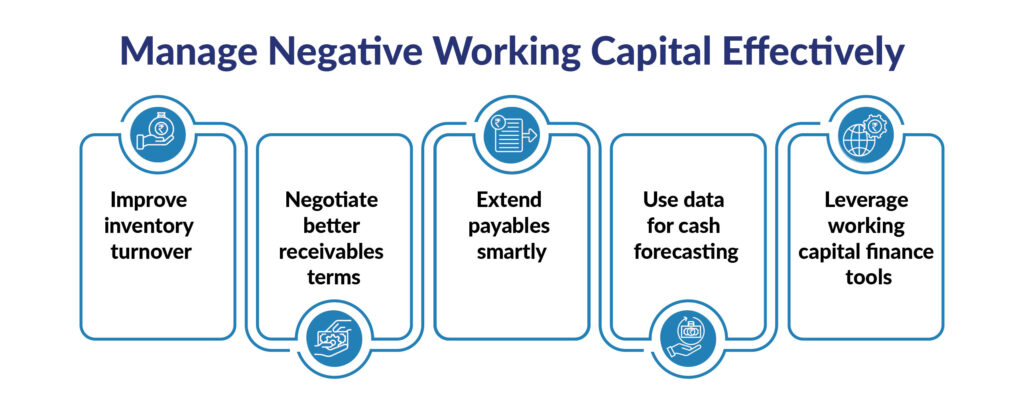

Here are practical ways to manage negative working capital effectively:

- Improve inventory turnover: Move products faster so cash isn’t locked in unsold stock.

- Negotiate better receivables terms: Encourage quicker customer payments, possibly with early-payment discounts.

- Extend payable terms where possible: Build strategic vendor partnerships to secure more flexible payment timelines.

- Use data for forecasting: Real-time dashboards and cash flow analytics help predict shortfalls and plan accordingly.

- Leverage working capital finance tools: Solutions like factoring, purchase invoice financing, and supply chain finance offer flexibility without heavy debt.

Companies that monitor working capital in real time and adjust quickly to external changes are far better positioned to make negative working capital work for them, not against them.

Avoiding Common Pitfalls in Working Capital Management

Many businesses fall into avoidable traps when it comes to working capital. From holding excessive inventory to delaying follow-ups on receivables, the cumulative effect can quietly drain a business of liquidity and stability.

To explore the most common mistakes and how to prevent them, check out this article on “10 Things That Businesses Should Avoid When Managing Their Working Capital”

This resource breaks down the typical errors that reduce financial efficiency and shows how to develop a more resilient working capital strategy.

Conclusion: One Metric, Many Meanings

Negative working capital is often misunderstood. For some businesses, it is a strategic approach that enables faster growth and stronger cash positions. For others, it can point to financial distress or inefficient operations. The difference lies in intent, context, and execution.

Understanding the negative working capital meaning in your business environment is essential. It is not about chasing a positive or negative number but about ensuring that short-term obligations are managed without sacrificing long-term goals.

The real takeaway? Negative working capital should never be accidental. If your business model supports it, and if cash flow is tightly monitored, it can work in your favour. But when it emerges as a byproduct of weak controls or reactive management, it becomes a risk you can’t afford to ignore.

Frequently Asked Questions (FAQ)

Q1. Is negative working capital the same as being in debt?

Ans. Not necessarily. While negative working capital means a business owes more in the short term than it owns in current assets, it does not always indicate long-term debt. It reflects liquidity, not solvency. A business can have negative working capital but still be profitable and debt-free if its cash flow is well managed.

Q2. Can a startup survive with negative working capital?

Ans. Yes, but it depends on the business model. Some startups, especially in sectors like e-commerce or digital services, may operate with negative working capital during early growth phases. However, they must carefully manage cash flow and monitor expenses to avoid liquidity traps.

Q3. How often should a company monitor its working capital?

Ans. Ideally, working capital should be reviewed monthly, especially for businesses with tight margins or fast-moving inventories. Regular tracking helps identify potential issues early and allows time to adjust purchasing, payment, or credit policies.

Q4. What’s the difference between negative working capital and cash flow problems?

Ans. Negative working capital is a balance sheet condition, while cash flow issues are operational. A company can have negative working capital yet strong cash flow, especially if it receives customer payments quickly. On the other hand, a business with positive working capital may still face cash shortages if collections are delayed or expenses spike.

Q5. Do banks view negative working capital as risky?

Ans. In many cases, yes. Banks often see negative working capital as a sign of financial risk, especially in industries where this model is uncommon. It may affect credit approvals, interest rates, or loan terms. However, in sectors where this is the norm, lenders may evaluate risk differently, especially if the company demonstrates healthy turnover and consistent cash inflow.