A business idea worth a million dollars is turned to dust if it does not receive the proper capital at the required time. To ensure the success of your start-up and hit the ground running, one needs adequate cash flow in their organization.

Thus, turning one’s story of rags-to-riches requires external help in terms of capital. Although the requisite qualities of an entrepreneur are their will to succeed and the hours burned to develop that perfect idea that solves the lurking problem of saving all humankind; unfortunately, these innovative and ambitious traits do not guarantee success. One needs to get investment for their vision to be executed to perfection and for the world to take notice of the product or services they produce and marvel at their innovation.

One can receive investment from banks or some other financial institution, or they can turn to angel investors, always ready to invest in the next big thing. But, getting an investor on board requires going through watchful scrutiny that is too strict. Banks are primarily reluctant to risk their money on some newbie wishing to make it big. Thus, applying for a small loan from a financial institution is the best option to acquire the required capital to fund your idea.

However, getting a business loan is a significant decision for entrepreneurs or small to medium business owners. The growth of your small business can be ensured by acquiring the capital to develop infrastructure and investments in machinery and operations.

This blog is written to help you understand how to get a business loan, the requisites for obtaining the sanctioned loan, the steps required to apply for the loan, and most importantly, whether to opt for a business loan.

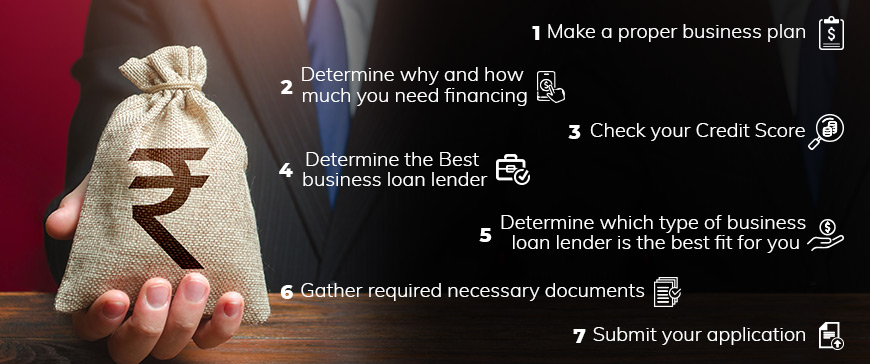

Make a Proper Business Plan

Before facing a lender, one must be aware of their business plan and be able to communicate their vision to the lender effectively. Going to the lender with a well-documented business plan would make them take you seriously. You must have your company profile ready when you are a small enterprise. If you have a prior social connection with the bank or the lender, it will prove beneficial while applying for the loan.

You must ensure that you meet all the eligibility criteria for obtaining a loan, such as having a solid credit portfolio, the experience of managing and running your business, income tax return filings and all the necessary, updated documents.

It is critical to have a clear plan in place to ensure that the funds are used as intended. Each lender wants to know how you plan to spend the funds and how the business will benefit because doing so will ensure they get paid on time.

A strong business plan contains details on your company’s goals, past accomplishments, and upcoming projects. It’s a terrific idea to include information on the management team, their qualifications, and their objectives for the company.

While putting together a business loan application, we highly advise seeking professional advice.

Determine Why and How Much You Need Financing

Any lender would be keen to know why you require a business loan. The lender would inquire about this to ensure the cash flow for loan repayments. A business in its starting phase is unlikely to get the loan sanctioned.

Alternative finance options, such as company credit cards and personal loans, will be necessary for your start-up.

Your business may need a loan for various reasons; some causes include the setup of machinery and ensuring the smooth functioning of operations, while other causes may include acquiring non-related business assets, additional cash to offset monthly losses, and urgent operating cash requirements during business slowdowns.

We suggest waiting to submit a loan application until you know the exact loan amount the company is requesting. Always determine the precise financial needs of the company to avoid a future surplus or shortage of funds, which will improve the likelihood that a business loan will be approved. A higher-than-expected loan approval could lead to financial waste and an uncomfortable debt load, while a lower-than-expected corporate loan acceptance could cause an operating cash bottleneck.

You must calculate the required loan amount by thoroughly analyzing the company requirements and projected plans in the future and make sure that each detail is included while doing the financial computation.

Your business can only avoid such grim scenarios by adopting a well-planned budgeting methodology.

Your budget would include all the lender inquiries and would provide the organization with the cash-flow perspective and the usage of funds. Chances of loan approval would go high when all the details are finely calculated and the organization has a crystal clear idea about the business requirements and the cash-flow outlook.

Check Your Credit Score

The lender’s decision to sanction the loan to any organization is highly dependent on the scrutiny of the company’s credit score. Solid credit health ensures lenders can trust the company, as the credit score defines an organization’s dependability and repayment capabilities. Because most lenders prefer it, we recommend a credit score of at least 750. The company’s age is also important. A lender may make a term loan or a working capital loan available to a company that has been running its operations for more than two years.

The other factor that earns the good faith of the lenders is the cash flow in an organization which allows the lender to measure the ability to repay the loan by the company.

Determine the Best Business Loan Lenders

Government banks such as SBI and PNB to privately owned banks such as HDFC and ICICI are a few of the foremost loan providers in India. Choosing a lender who would facilitate your accessibility of getting loan sanctioned and easy and flexible repayment options requires extensive labour.

The primary conditions that the lender should meet and to be taken into consideration by you are – qualifying criteria for the loan, loan perks, and loan repayment terms and conditions. You may receive the best loan offer from numerous online lending organizations such as Mynd Fintech.

Determine Which Type of Business Loan Lender is the Best Fit for You

Various lenders provide easy loans tailored to small businesses demands. Online loan providers, banks, and non-banking finance companies are primary sources where you can get the required capital for your business.

Borrowing from an online lender is best suited for you if you do not have much time on your hands, don’t have collateral to produce, and need the cash immediately.

Banks require lots of documentation and their processing time is usually longer than other options readily available at your disposal. Micro-lenders are also an excellent option to take loans for your small business, but as the name suggests, the capital you can acquire from these sources would be ‘micro’.

Gather Required Necessary Documents

Before applying for the loan, you must have all the required necessary documents. The essential documents to quicken the process of obtaining loans for small businesses are:

- PAN Card

- Tax returns for Business and the Individual

- Bank statements for Business and the Individual

- Financial statements of the Business

- Address proof

- GST information

- Consent for accessing bureau records

Learn more: Checklist of Documents to Consider Before Applying for a Business Loan Application

Submit Your Application

After gathering all the information, you are required to draft a proposal for the lender best suited for you. A business loan application is required to obtain the necessary loan amount for company development and operating sustainability. You should write the business loan application so that the loan provider agrees to the requested amount for the company. The profile of the business owner, business papers, and financial statements must all be included in the business loan application. The documentation should be accessible to loan providers.

Conclusion

From business development to cash flow management, business finance is an effective way for firms to generate the necessary funds and scale up quickly. A company can benefit from lucrative financial leverage and other monetary benefits.

Before going to a lender to get the loan sanctioned for your small business and the investment to expand it, you must compare different lenders and select the best fit for you. Compare the two or three shortlisted options based on loan conditions and annual percentage rate.

It is the simplest way to understand a business loan’s annual cost because it considers all loan costs in addition to the interest rate. Choose the loan with the lowest interest rate and submit your documentation. It’s important to note that credit bureaus don’t distinguish between commercial and personal inquiries. If you use your credit history when applying for a small business loan, your credit score may suffer, which is why choosing the best option is critical.

Mynd Fintech is one of the leading platforms to invest in small businesses and helps them grow leaps and bounds. This online platform requires no collateral and provides secure loans in less than 48 hours. You can lend from Mynd Fintech to ensure the proper cash flow in your organization. We provide accessible funding alternatives and flexible repayment options to help small business owners. Interest rates on our loans are reasonable, we require minimal paperwork, and our scrutiny process is quick.

FAQs

Q.1 Why should I take a business loan?

Ans. If you are a small business and wish to expand your business or ensure to smoothen the function of operations, you can opt for a long-term or short-term business loan, depending on your requirements from the lender that suits you.

Q.2 Can someone with Bad credit obtain the loan?

Ans. Yes, someone with a bad credit score can obtain a loan. In such cases, one has to present solid collateral to put the lender’s faith in getting a payback.

Q.3 What is the minimum credit score needed for a business loan?

Ans. To get a business loan sanctioned for your business, you must have a minimum credit score of 650. CIBIL score of less than 650 is termed average or even poor in some cases.

Q.4 Is it difficult for small businesses to obtain loans?

Ans. Yes, it is comparatively complex for a small business to get a business loan. Lenders have strict requirements that must be met by small businesses to get the loan sanctioned. Thus, online lenders are the best fit for a small business that needs to expand its operations and increase the cash flow in its organization.