Maintaining healthy cash flow is essential for businesses, and invoice financing is an effective solution for unlocking funds tied up in unpaid invoices. However, choosing the right invoice financing provider can significantly impact your financial strategy. Here’s a comprehensive guide to evaluating the best invoice financing companies in India.

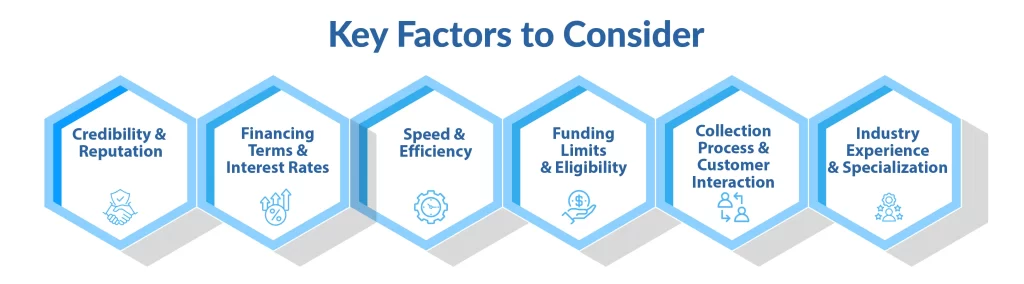

Key Factors to Consider

-

Credibility & Reputation

Research the company’s reputation in the market. Look for reviews, client testimonials, and industry ratings to ensure they have a track record of reliability and trustworthiness.

-

Financing Terms & Interest Rates

Compare terms offered by different providers, including:

-

- Discounting fees and interest rates

- Advance payment percentage

- Repayment flexibility

- Additional hidden charges

Choose a company that provides transparent and competitive rates with flexible repayment options.

-

Speed & Efficiency

One of the primary benefits of invoice financing is quick access to funds. Evaluate how long companies take to approve and disburse funds. Providers with streamlined digital processes are preferable for faster approvals and minimal paperwork.

-

Funding Limits & Eligibility

Providers have varied funding limits and eligibility criteria. Some cater specifically to SMEs, while others support large enterprises. Ensure the company aligns with your business size and financing requirements.

-

Collection Process & Customer Interaction

If opting for invoice factoring, assess whether the provider will interact with your customers directly. It’s crucial to choose a company that handles collections professionally without straining client relationships.

-

Industry Experience & Specialization

Some invoice financing companies specialize in certain industries, offering tailored solutions for manufacturing, logistics, retail, and more. Choosing a provider with experience in your sector can lead to better terms and services.

Why Choose Mynd Fintech for Invoice Financing?

Mynd Fintech offers tailored invoice financing solutions designed to support businesses with fast, flexible, and transparent funding options. Here’s why businesses trust us:

- Quick & Hassle-Free Approvals – Get funds within 24-48 hours.

- Competitive Rates – Transparent pricing with no hidden charges.

- Flexible Solutions – Custom financing plans to suit business needs.

- Technology-Driven Process – Digital applications for seamless transactions.

Ready to improve your cash flow? Discover how Mynd Fintech can help your business unlock working capital within 24 hours. Get started today!

FAQs

Q. What is the difference between invoice discounting and invoice factoring?

Ans. Invoice discounting allows businesses to retain control over collections, while invoice factoring involves selling invoices to a financing company that handles collections.

Q. How fast can I get funds through invoice financing?

Ans. With digital financing platforms like Mynd Fintech, you can receive funds within 24-48 hours after approval.

Q. Is invoice financing suitable for small businesses?

Ans. Yes, many invoice financing companies cater specifically to SMEs, offering flexible and tailored solutions.

Q. Are there risks associated with invoice financing?

Ans. While invoice financing helps maintain cash flow, businesses should be aware of interest rates, fees, and potential customer interactions with the financier.

Looking to unlock funds from unpaid invoices? Contact Mynd Fintech now to explore the best financing options for your business!