Why Cash Flow Matters for Large Businesses

Cash flow is the backbone of any business, regardless of its size. However, for large enterprises with complex operations and high working capital needs, managing cash flow efficiently becomes even more critical. Even if a business is profitable on paper, delayed payments from clients can create financial bottlenecks, impacting day-to-day operations, vendor payments, and growth opportunities.

This is where bill discounting comes in as a strategic financial tool. By leveraging unpaid invoices, businesses can access immediate cash without waiting for their clients to pay. This not only ensures smooth operations but also helps companies maintain strong relationships with suppliers and employees.

Understanding Bill Discounting: What It Is and How It Works

Bill discounting is a financial instrument that allows businesses to convert their accounts receivable into immediate cash by selling invoices to a bank or financial institution at a discount. Instead of waiting 30, 60, or 90 days for customers to pay, companies can access funds upfront to keep operations running smoothly.

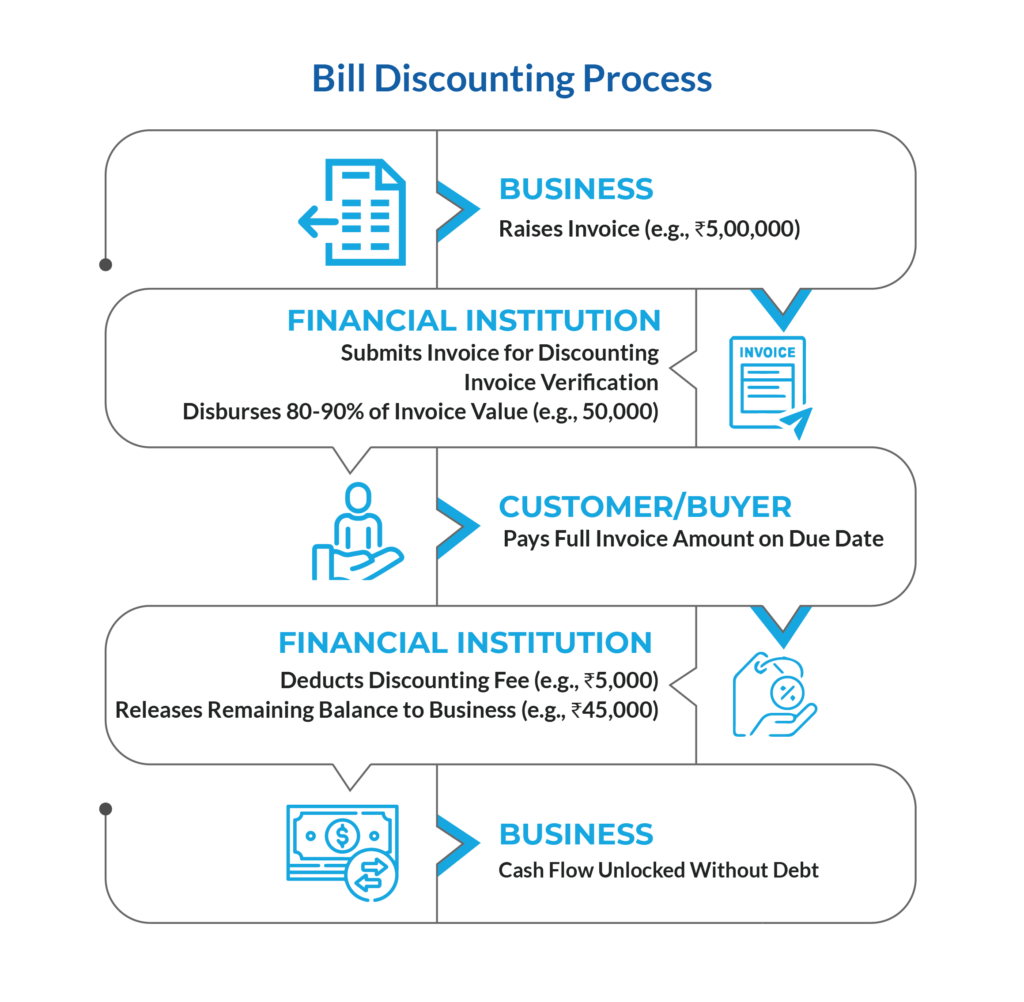

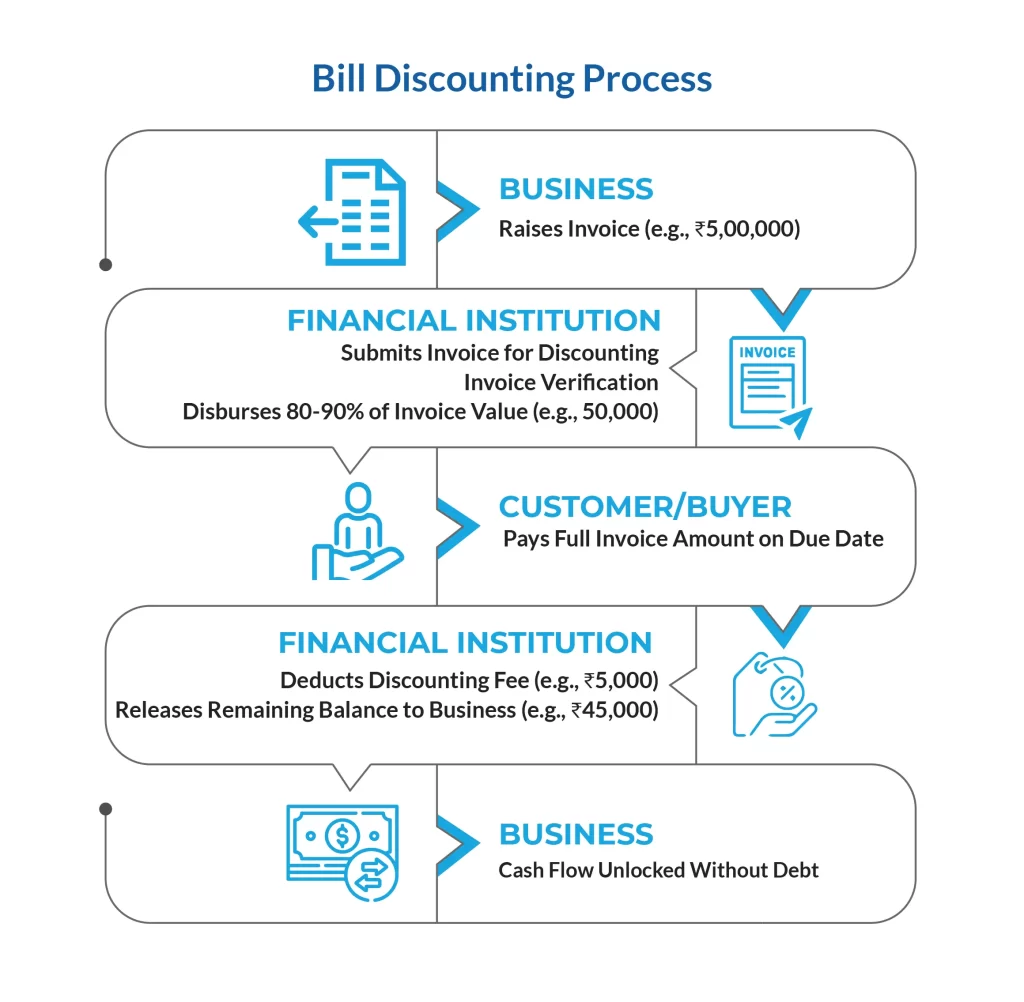

How It Works:

- A business sells goods/services and generates an invoice for the customer.

- Instead of waiting for the payment due date, the business approaches a financial institution for bill discounting.

- The institution verifies the invoice and advances a percentage of its value (typically 80-90%).

- The customer makes the payment on the due date, and the financial institution collects the full amount.

- The remaining balance is then transferred to the business, minus a small discounting fee.

This process enables businesses to optimize cash flow without taking on additional debt.

Advantages of Bill Discounting for Large Businesses

Leveraging bill discounting offers multiple advantages that go beyond just unlocking cash flow.

- Immediate Liquidity Without Adding Debt

Unlike traditional loans, bill discounting doesn’t require businesses to take on new liabilities. It simply accelerates access to funds that are already owed.

- Strengthens Supplier Relationships

With a steady cash flow, businesses can make timely payments to vendors, securing better deals and strengthening supply chain relationships.

- Enhances Financial Planning

By reducing uncertainty around receivables, companies can plan investments, payroll, and other expenses with confidence.

- Reduces Dependence on Traditional Loans

Instead of applying for working capital loans with lengthy approval processes and interest burdens, businesses can utilize their own receivables for financing.

Industries That Can Benefit the Most from Bill Discounting

While bill discounting can be used across sectors, some industries benefit more due to their reliance on extended credit periods and large receivables.

- Manufacturing & Supply Chain: Large production cycles require ongoing liquidity to purchase raw materials and manage operations.

- Retail & E-commerce: Businesses in these sectors deal with high volumes of transactions and delayed customer payments.

- Infrastructure & Construction: Large-scale projects often have long payment cycles, making cash flow management essential.

- Service-Based Enterprises: Companies providing IT, consulting, or other B2B services often face delayed invoice payments.

How to Get Started with Bill Discounting

Step 1: Choose the Right Financial Partner

Not all institutions offer the same terms for bill discounting. Businesses should evaluate interest rates, processing fees, and reputation before selecting a partner.

Step 2: Prepare Your Invoices for Discounting

Ensure that your invoices meet the eligibility criteria, such as being raised for reputed buyers and having a clear payment timeline.

Step 3: Submit the Invoice and Get Funds

Once approved, the financial institution will disburse funds quickly, often within 24-48 hours.

Potential Risks and How to Mitigate Them

- Risk of Invoice Rejection

Financial institutions may reject invoices if the buyer has poor creditworthiness. To mitigate this, businesses should work with reliable clients.

- Managing Costs and Fees

While bill discounting is an efficient cash flow tool, businesses should factor in the discounting charges to ensure it remains a cost-effective solution.

- Ensuring Timely Payments

If the buyer delays or defaults on the payment, the business may be liable. Choosing a reputable financial partner that offers risk mitigation solutions can help.

Conclusion: Unlocking Growth with Smarter Cash Flow Management

Bill discounting is not just a short-term fix—it’s a strategic financial tool that empowers businesses to maintain liquidity, strengthen relationships, and invest in growth opportunities. By leveraging their receivables efficiently, companies can navigate financial uncertainties and scale sustainably.

For businesses looking to optimize cash flow without adding debt, exploring bill discounting with the right financial partner can be a game-changer.

FAQs: Answering Common Questions on Bill Discounting

Q1: How is bill discounting different from invoice factoring?

Ans. While both involve selling invoices, in bill discounting, the business remains responsible for collecting payments. In invoice factoring, the financial institution takes over collections.

Q2: Can startups use bill discounting?

Ans. Yes, but financial institutions usually prefer businesses with established credit histories and invoices from reputable buyers.

Q3: What percentage of the invoice value can I receive?

Ans. Typically, businesses receive 80-90% of the invoice value upfront, with the remainder paid after the customer settles the invoice.

Q4: Does bill discounting affect my balance sheet?

Ans. No, since it’s not a loan, it doesn’t increase liabilities on your balance sheet. Instead, it helps improve cash flow without adding debt.

Q5: Is bill discounting regulated in India?

Ans. Yes, bill discounting is regulated by the Reserve Bank of India (RBI), and businesses should work with RBI-registered financial institutions to ensure compliance.