In today’s business world, managing cash flow well is key to success. One powerful tool that can help businesses improve their cash flow is invoice discounting. Invoice discounting allows businesses to sell their unpaid invoices to a third party at a discount. This means companies can access funds immediately instead of waiting for their customers to pay. By turning invoices into instant cash, businesses can maintain smooth operations, meet urgent expenses, and invest in growth opportunities without delays.

Discover how invoice discounting can transform your cash flow management and drive your business forward. Don’t let unpaid invoices hold you back—explore this powerful financial solution today and take control of your working capital. This article looks at what invoice discounting is, its benefits, and how it can be a game-changer for MSMEs and other businesses aiming to optimize their working capital.

Concept of Invoice Discounting

Invoice discounting is a financial arrangement where businesses sell their outstanding invoices to a third-party financier at a discount. This allows them to receive immediate cash instead of waiting for the payment terms to be fulfilled. The financier collects the payment from the customer when the invoice is due.

Let’s understand this by an example, imagine an MSME in India that supplies goods to a large retail chain. The retail chain usually pays its invoices 60 days after receiving the goods. To keep their cash flow steady, the MSME can sell these invoices to a financier at a discount. This means they get most of the money right away, instead of waiting two months. The financier then collects the full payment from the retail chain when the invoice is due. This way, the MSME has immediate cash to manage daily operations and invest in growth, while the financier earns from the discount provided.

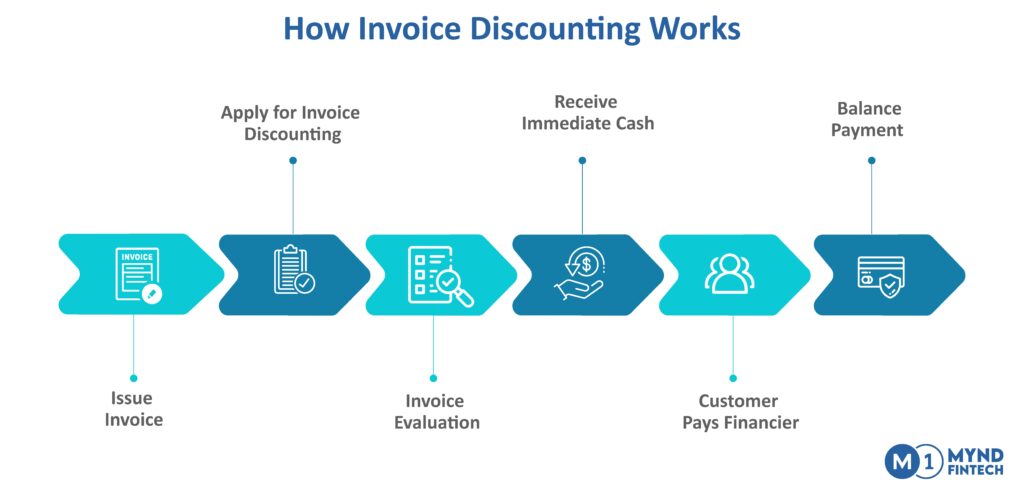

How Invoice Discounting Works

- Issue Invoice: The business sells goods or services to a customer and issues an invoice with a payment term (e.g., 60 days).

- Apply for Invoice Discounting: The business approaches a financier (such as a bank or a specialized finance company) and submits the unpaid invoice for discounting.

- Invoice Evaluation: The financier evaluates the invoice and the creditworthiness of the customer who will pay it.

- Receive Immediate Cash: Upon approval, the financier provides the business with a large percentage of the invoice value upfront (typically 80-90%).

- Customer Pays Financier: When the invoice is due, the customer pays the full invoice amount directly to the financier.

- Balance Payment: Once the financier receives the payment from the customer, they deduct their fee (discount rate) and remit the remaining balance to the business.

Benefits of Invoice Discounting for MSMEs

- Improved Cash Flow: Invoice discounting provides immediate access to cash by converting unpaid invoices into working capital. This helps MSMEs meet daily operational expenses, invest in growth opportunities, and manage cash flow gaps without waiting for customers to pay.

- Enhanced Working Capital: By unlocking funds tied up in unpaid invoices, MSMEs can strengthen their working capital position. This enables them to take on larger orders, purchase inventory in bulk at discounted rates, and pursue business expansions or improvements.

- Reduction of Credit Risk: When invoices are discounted, the financier takes on the responsibility of collecting payments from customers. This reduces the MSME’s exposure to credit risk and potential bad debts, enhancing financial stability and predictability.

- Flexibility and Scalability: Invoice discounting offers MSMEs flexibility in managing their finances. They can choose which invoices to discount and when, based on their immediate cash flow needs. This scalability allows businesses to adjust financing according to fluctuating demand or seasonal variations.

- Increased Negotiation Power with Suppliers: With improved cash flow and stronger working capital, MSMEs can negotiate better terms with their suppliers. They can take advantage of early payment discounts or negotiate longer credit periods, improving overall cost efficiency and profitability.

Types of Invoice Discounting

- Recourse vs. Non-Recourse Invoice Discounting:

- Recourse Invoice Discounting: In this type, the MSME retains responsibility for collecting payment from the customer. If the customer fails to pay, the financier can reclaim the discounted amount from the MSME.

- Non-Recourse Invoice Discounting: Here, the financier assumes the credit risk. If the customer fails to pay the invoice (due to insolvency or non-payment), the financier cannot reclaim the discounted amount from the MSME. Non-recourse invoice discounting typically involves higher fees due to the increased risk borne by the financier.

- Confidential vs. Disclosed Invoice Discounting:

- Confidential Invoice Discounting: In this arrangement, the MSME retains control over customer relationships and collections. The customers are unaware that invoices have been discounted, preserving the business’s reputation and customer relationships.

- Disclosed Invoice Discounting: Here, the customers are notified that the invoices have been discounted to a third-party financier. The financier manages the collection process directly with the customers. This type may offer lower discount rates due to reduced risk for the financier.

- Selective vs. Whole Turnover Invoice Discounting:

- Selective Invoice Discounting: MSMEs can selectively choose which invoices to discount based on their immediate cash flow needs. This flexibility allows them to manage financing according to specific invoices or customers.

- Whole Turnover Invoice Discounting: In contrast, this type involves discounting all eligible invoices within a specified period (e.g., monthly or quarterly). It provides a consistent cash flow solution but may involve higher administrative efforts to manage all invoices.

Invoice Discounting vs. Bank Loans

A) Bank Loans: Bank loans usually require MSMEs to pledge assets (like property or equipment) as collateral to secure the loan.

- Collateral provides security for the bank in case the borrower defaults on the loan repayment. It can limit borrowing options for businesses without substantial assets.

- Banks evaluate creditworthiness, review business plans, and may take weeks to approve and disburse funds. It is a lengthy approval process can delay access to funds needed for immediate business expenses or opportunities.

B) Invoice Discounting: Unlike bank loans, invoice discounting does not require businesses to pledge collateral.

- MSMEs submit invoices to a financier who evaluates and approves the discounting. Funds (typically 80-90% of invoice value) are disbursed quickly.

- This flexibility enables businesses without significant assets to access financing based on their sales invoices, enhancing liquidity without risking valuable assets.

Why Choose Mynd Fintech?

- Access to Quick Funds: Mynd Fintech allows businesses to raise funds against their purchase invoices, enabling them to maintain liquidity and avoid tying up capital in unpaid invoices.

- Improved Cash Flow: By leveraging purchase invoice discounting, businesses can access early payment discounts from suppliers without impacting their cash reserves, thus improving cash flow management.

- Stronger Supplier Relationships: Timely payments through invoice discounting can strengthen relationships with suppliers, fostering trust and reliability.

- Streamlined Processes: Mynd Fintech offers digital integration with sellers’ ERP systems for seamless invoice handling and payment processes, reducing administrative burdens.

Conclusion

Invoice discounting is a powerful tool for improving cash flow, enhancing working capital, and reducing credit risk. It offers flexibility, scalability, and immediate access to cash, making it an attractive option for many businesses. Mynd Fintech’s Purchase Invoice Discounting service offers businesses a strategic advantage by improving cash flow, enhancing negotiating power, and streamlining financial processes, thereby fostering stronger supplier relationships and operational efficiency.

Read More: