Introduction

Working capital, also known as net working capital (NWC), as we all understand is the difference between a company’s Current Assets—such as Cash, Accounts Receivable i.e. Customers’/Buyer’s unpaid Invoices, and Inventories of Raw Materials and Finished Goods—and its Current Liabilities, such as Accounts Payable i.e. Vendors/Sellers unpaid Invoices and Debts. It’s a commonly used measurement to gauge the short-term health of an organization.

Current assets

Current assets are all assets that a company expects to convert to cash within one year. It is commonly used to measure the liquidity of a company.

Current liabilities

Current liabilities are financial obligations of a business entity that are due and payable within a year. A liability occurs when a company has undergone a transaction that has generated an expectation for a future outflow of cash or other economic resources.

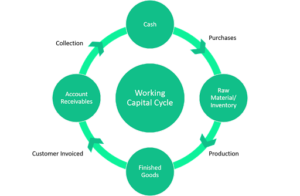

Working Capital Cycle

The working capital cycle for a business is the length of time it takes to convert the total net working capital (current assets less current liabilities) into cash.

The working capital cycle formula is Inventory Days + Receivable Days – Payable Days e.g. If Inventory days are 80, Receivable days are 30 and Payable days are 90, Working Capital Cycle shall be 80 + 30 – 90 = 20. This means the company is only out-of-pocket cash for 20 days before receiving full payment.

If a company has substantial positive NWC, then it could have the potential to invest in expansion and grow the company. If a company’s current assets do not exceed its current liabilities, it indicates the company has low liquidity and could have a potential problem in paying its creditors and repayment of debt obligations as they become due.

The amount of working capital a company has will typically depend on its industry.

Some sectors that have longer production cycles may require higher working capital needs as they don’t have the quick inventory turnover to generate cash on demand. Alternatively, retail companies that interact with thousands of customers a day can often raise short-term funds much faster and require lower working capital requirements.

For efficient management of Working Capital/Cash Flows, Businesses primarily manage three Levers of performance i.e. Inventory Turnover, Sales Collection efficiency, and seeking/demanding credit for Purchases.

Businesses typically try to manage this cycle by selling inventory quickly, collecting revenue from Customers/Buyers quickly, and delaying payments for Procurement from Vendors/Sellers to optimize cash flow.

Introduction to Supply Chain and its Importance

As we understand, the Supply Chain is an ecosystem of individuals and companies. Who are involved in creating a product or rendering a service and delivering it to the consumer. In the case of a Manufacturer, Links on the chain begin with the producers of the raw materials and end when the finished products get delivered to the end user/consumer.

Supply chain management is a crucial process because an optimized supply chain results in lower costs and a more efficient production cycle. Companies seek to improve their supply chains so they can reduce their costs and remain competitive.

Supply Chain Financing plays a vital aspect of Supply Chain Management as it helps in lowering financing costs and improving business efficiency for Buyers and Sellers linked in a Sales Transaction and includes, Factoring, Purchase Order Finance, Purchase Invoice Discounting, Vendor Finance, Dealer Finance, Inventory Finance, Sales Invoice Discounting etc. as offered on the M2 Platform.

How Does Supply Chain Work for Businesses

The supply chain is the process of transforming raw materials into finished products and delivering them to customers. It involves various interconnected activities, including procurement, production, logistics, and distribution. The supply chain plays a crucial role in the overall operations of businesses and has a significant impact on working capital.

Working capital refers to the funds a business needs to finance its day-to-day operations. It represents the difference between a company’s current assets (such as cash, inventory, and accounts receivable) and its current liabilities (such as accounts payable and short-term debt). Efficient management of the supply chain directly affects a company’s working capital in several ways:

- Procurement and Inventory Management: The supply chain begins with procurement, where businesses source raw materials and components. Effective procurement strategies aim to balance the availability of materials with minimizing inventory holding costs. By optimizing procurement and inventory management, businesses can reduce the amount of tied-up working capital in excess inventory.

- Production Efficiency: Smooth and efficient production processes are essential for minimizing working capital requirements. Streamlining production operations can lead to reduced lead times, lower production costs, and improved cash flow. Effective production planning and scheduling help prevent bottlenecks and ensure optimal utilization of resources, ultimately minimizing working capital needs.

- Supplier Relationships: Maintaining good relationships with suppliers is crucial for managing working capital effectively. Negotiating favourable payment terms with suppliers, such as extended payment periods or early payment discounts, can provide businesses with more flexibility in managing their cash flow. Strong supplier relationships can also lead to improved reliability in the supply chain, reducing the risk of disruptions and inventory shortages.

- Logistics and Distribution: Efficient transportation and distribution processes are key to minimizing working capital requirements. Hence, by optimizing logistics, businesses can reduce lead times, decrease transportation costs, and ensure timely delivery of products to customers. This helps in improving cash flow by shortening the order-to-cash cycle and minimizing the time between incurring costs and receiving revenue.

- Demand Forecasting and Customer Service: Accurate demand forecasting is crucial for optimizing inventory levels and reducing working capital requirements. By aligning production and inventory levels with anticipated customer demand, businesses can avoid overstocking or stockouts, both of which can tie up working capital unnecessarily. Additionally, providing excellent customer service and responsiveness helps in maintaining customer loyalty and minimizing order cancellations or returns, further enhancing working capital efficiency.

In summary, a well-managed supply chain can have a significant impact on a company’s working capital. By optimizing procurement, sources of working capital, production, logistics, and distribution processes, businesses can reduce inventory holding costs, improve cash flow, and enhance overall operational efficiency. Effective supply chain management is essential for businesses aiming to achieve better working capital management and financial stability.

M2 Platform Offering Value-Added Services for Their Members

M2 Platform is offering the following value-added services to all the Members of this Supply Chain i.e. Sellers, Buyers and Financiers to not only facilitate Supply Chain Financing but also make it Paperless, Frictionless and Efficient.

1. Integration with Member Systems

Depending upon the compatibility/integration readiness of the Member systems with the M2 Platform. The Company offers standard integration services to facilitate a seamless flow of invoices without any manual intervention. This enables invoice flow in real time without any tampering.

2. Digital Buyer/Supplier Onboarding

M2 Platform offers end-to-end digital onboarding of Buyer(s) and Supplier(s) using real-time verification of information wherever available. Common repository of KYCs (Pan Card, Address Proof etc.), Video-KYC for proprietors, Penny-drop Service for bank a/c validation, PAN Validation, Online data submission and document upload.

3. Digital document collection capabilities

M2 Platform facilitates the digital generation and execution of Transactional Disbursement Documents, uploading and acceptance/execution of the same electronically/digitally.

4. Digital Credit Analytics Engine

M2 Platform’s digital credit analytics engine helps generate digital data analytics of the Buyer(s) and Supplier(s) to assist the Financier in limit sanctioning as per the Financier’s requirements communicated to the Company.

5. Digital Transaction Manager

- Factoring Transactions: M2 Platform facilitates the electronic generation of the Deed of Assignment and acceptance/execution of the same electronically/digitally. Further, upon acceptance of the Deed of Assignment, the M2 Platform electronically generates a notice of assignment on behalf of the Financier and transmits the same to the email address of the Buyer/Financier/Supplier as per the records available with the Company (at the time of onboarding or as updated by the Member(s)).

- Other Supply Chain Finance Transactions: M2 Platform offers digital functionalities for Buyer(s) and Supplier(s) to undertake the Transaction(s) as per Process flow. M2 Platform’s transaction module helps Financier(s), Buyer(s) and Supplier(s) in the digital generation of the Transactional Disbursement Document, uploading and acceptance/execution of the same electronically/digitally. The M2 Platform transaction generates Transaction reports, which can be downloaded by the Financier on log-in to the M2 Platform.

The Overall Benefits of the M2 Platform for Business

Overall, MYND Fintech offers a range of valuable benefits for businesses, such as sources of working capital, Early Payment Discount, Dynamic discounting, and Invoice Financing. With its comprehensive suite of financial tools and services, MYND Fintech empowers businesses to streamline their financial operations, optimize cash flow, and make informed decisions. The platform’s advanced features, such as cash flow forecasting, automated bookkeeping, and real-time financial insights. That enable businesses to gain better control over their finances and improve overall financial performance. MYND Fintech also provides seamless integration with existing accounting systems, ensuring a smooth transition and minimizing disruption. By leveraging the power of technology and automation, MYND Fintech simplifies financial management, saves time and resources, and ultimately helps businesses achieve greater financial success. Whether it’s cash flow management, expense tracking, or financial reporting, MYND Fintech is a game-changer for businesses seeking efficient and effective financial solutions.