Staying financially healthy isn’t just about turning a profit. It’s about having the flexibility to respond to changes, cover everyday costs, and keep operations moving. That’s where working capital becomes essential.

Working capital is the money available to cover short-term expenses—like paying suppliers, covering salaries, and managing inventory. It’s the financial cushion that helps businesses survive and grow. Without it, even profitable companies can struggle to stay afloat.

In this blog, we’ll explore the benefits of working capital, why it matters, and how managing it well can improve financial performance. Whether you’re a startup or a growing business, understanding the importance of working capital is key to long-term success.

What Is Working Capital and Why It Matters

Working capital is the difference between what a business owns (current assets) and what it owes (current liabilities). When that difference is positive, the business can meet its short-term obligations. When it’s negative, the business may face cash flow problems.

But working capital isn’t just a number on a balance sheet. It’s what keeps the business running. It helps pay bills, restock inventory, and handle unexpected expenses. The significance of working capital becomes clear when a business needs to react quickly—like grabbing a new opportunity or managing a sudden drop in revenue.

Simply put, the importance of working capital lies in its ability to keep a business stable and ready for what’s next. Without it, operations can stall, relationships can suffer, and growth may slow down.

The Importance of Working Capital Management

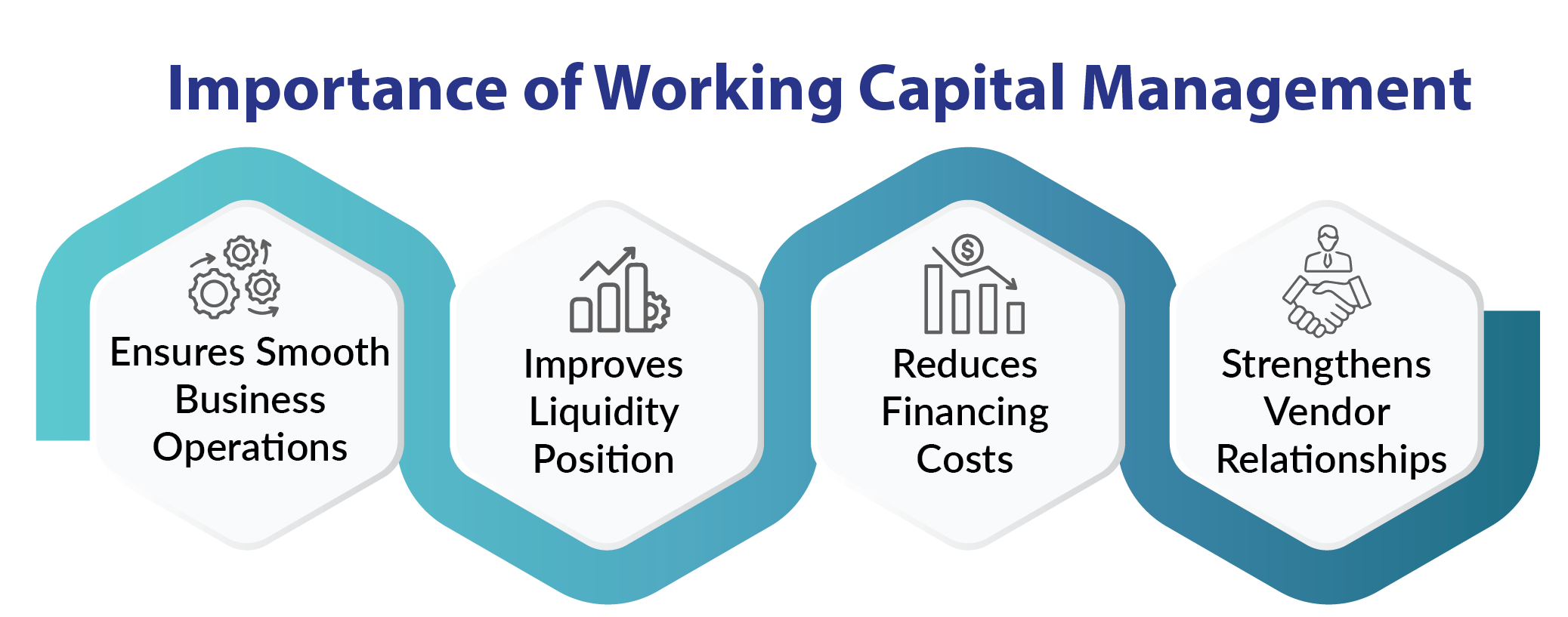

Having working capital is one thing. Managing it well is another. That’s where working capital management comes in. It’s all about making smart decisions around cash, inventory, and payments to keep money flowing smoothly.

When businesses manage their working capital effectively, they can:

- Maintain steady cash flow by improving the inflow and outflow of funds efficiently

- Strengthen supplier and customer relationships through reliable financial planning

- Reduce excess inventory or stock shortages by aligning procurement with actual demand

- Minimize short-term financing needs through better liquidity control

The importance of working capital management shows up in both the day-to-day and long-term performance of a company. If it’s not handled well, cash can get tied up in unpaid invoices or excess inventory. That can lead to missed opportunities or even financial trouble.

This is clearly highlighted in the article “Working Capital Problems and Solutions: How to Manage Shortfalls“ where they explain how common issues like delayed customer payments and high operational costs can create serious cash flow gaps. They also offer practical solutions, such as tightening billing cycles and adopting digital tools for better visibility and control.

The significance of working capital management grows even more when a company is scaling or facing uncertain market conditions. A proactive approach can make all the difference.

Key Benefits of Working Capital Management

Managing working capital well brings a range of real benefits. It helps companies stay financially stable and ready to grow. Here are some of the most important benefits of working capital management:

- Better cash flow

Faster collections and controlled spending mean more available cash. - Lower borrowing costs

With steady cash flow, businesses can avoid unnecessary short-term borrowing. - Stronger supplier relationships

On-time payments build trust and can lead to better pricing or priority service. - Business continuity

Adequate working capital helps a company keep running, even during slow seasons or market shifts. - Flexibility to grow

Access to liquid funds means businesses can act quickly on new opportunities.

When businesses understand and apply the advantages of working capital management, they build a stronger foundation for everything else—sales, service, strategy, and sustainability.

Risks of Poor Working Capital Management

While working capital is a vital asset for any business, it must be managed wisely. Poor planning or lack of control over working capital can create financial pressure, limit flexibility, and increase risk. The problem often lies not in the availability of working capital, but in how it is managed.

Here are some of the common risks that come from poor working capital management:

- Cash flow gaps

Delayed collections from customers or poor invoicing practices can lead to shortages, even when sales are strong. - Excess inventory holding

Holding more stock than needed ties up cash, increases storage costs, and can lead to product obsolescence. - Missed payment obligations

Inadequate working capital may result in late payments to suppliers, penalties, or strained vendor relationships. - Overreliance on short-term borrowing

Poor cash planning often forces businesses to take on expensive credit lines, increasing interest costs and financial stress. - Restricted growth

Without sufficient liquidity, businesses may miss out on time-sensitive opportunities like bulk purchases, market expansion, or product launches.

The key takeaway is that working capital needs ongoing attention. Monitoring inflows and outflows, forecasting cash needs, and optimizing receivables, payables, and inventory are all essential. This is why the importance of working capital management should be a top priority for financial leaders aiming to keep their businesses strong and agile.

Working Capital Is a Business Essential

Working capital is more than a financial metric. It is a measure of a company’s ability to manage uncertainty, maintain stability, and pursue growth. When managed well, it strengthens every part of a business, from operations and supplier relationships to strategic planning and risk management.

As we’ve explored throughout this article, strong working capital management drives stability, agility, and sustainable growth. The benefits of working capital management and the importance of maintaining adequate working capital all point to one clear message: Working capital is a cornerstone of business success.

Whether you are leading a startup, managing an established business, or preparing for growth, efficient management of working capital should be a key part of your financial strategy. A healthy working capital position gives your business the power to survive, adapt, and succeed—both now and in the long term.

Frequently Asked Questions (FAQs)

Q.1 How do I know if my business has too much working capital?

Ans. While having a financial cushion is good, too much working capital can signal that your money is tied up in areas like excess inventory or unpaid receivables. A working capital ratio above 2:1 might suggest that your business is not using its resources efficiently. Regular financial analysis and benchmarking against your industry standards can help you determine the right balance.

Q.2 What are the common mistakes businesses make in managing working capital?

Ans. Some of the most common mistakes include ignoring accounts receivable aging, overstocking inventory, failing to negotiate supplier terms, and not forecasting cash flow. These issues can lead to liquidity problems even when the business is profitable on paper.

Q.3 How often should I review my working capital position?

Ans. It’s a good practice to review working capital monthly, especially for small and mid-sized businesses. For companies in fast-moving industries or with seasonal cycles, weekly or bi-weekly monitoring might be necessary to stay agile and responsive.

Q.4 Is working capital the same as cash flow?

Ans. Not exactly. Working capital is a snapshot of current assets minus current liabilities, while cash flow tracks the movement of money in and out of your business over time. Both are essential for financial health, but they measure different things. A company can have positive working capital but still face cash flow issues if receivables are delayed or expenses spike suddenly.

Q.5 Can improving working capital increase profitability?

Ans. Yes, improving working capital can indirectly boost profitability. Efficient use of cash, faster collections, and better payment terms reduce costs and free up resources for growth. This leads to better margins and financial performance over time.

Q.6 What role does technology play in working capital optimization?

Ans. Technology helps automate and streamline processes like invoicing, payment tracking, and inventory management. It also provides real-time visibility into cash positions and financial risks. Using digital tools can improve accuracy, reduce delays, and support better decision-making around working capital.