In the world of enterprise finance, Accounts Payable (AP) often seems like a back-office function that only manages invoices and payments. But beneath the surface, how businesses handle invoice processing directly influences cash flow, supplier relationships, and ultimately growth.

Efficient invoice processing is not just about paying bills on time, it is the foundation for better liquidity management and stronger supplier relationships. More importantly, when paired with modern financing tools, AP can evolve from a cost center into a strategic enabler of business expansion.

In this blog, we’ll explore how invoice processing works, why it matters in Accounts Payable, and how enterprises can unlock additional value through Mynd Fintech’s working capital solutions.

What Is Invoice Processing in Accounts Payable?

Invoice processing is the workflow that organizations follow to handle invoices from suppliers before making payment. The process typically includes:

- Invoice Receipt – invoices received via email, supplier portals, or post

- Data Capture – extracting key fields like supplier details, invoice number, tax, and amount

- Validation and Matching – ensuring invoices align with Purchase Orders and goods received

- Approval Routing – passing invoices through internal stakeholders for authorization

- Payment Scheduling – releasing funds as per agreed credit terms

- Archival – maintaining records for audits and compliance

This process may seem routine, but delays or errors can quickly impact business operations, supplier trust, and cash flow.

Why Efficient Invoice Processing Matters

For enterprises handling thousands of invoices every month, efficiency in AP is critical. Poorly managed invoice process doesn’t just delay payments; it blocks liquidity, strains supplier relationships, and exposes the business to compliance risks:

Common challenges of inefficient invoice processing include:

- Delayed payments that strain supplier relationships

- Missed early payment discounts, leaving money on table

- Compliance risks due to errors or incomplete records

- Working capital bottlenecks with funds tied up unnecessarily

By contrast, streamlined invoice workflows enable:

- Faster turnaround times

- Clear visibility of liabilities and cash positions

- Stronger supplier partnerships

- Improved cash flow predictability

But here’s the real opportunity: when integrated with financing solutions, invoice processing becomes a gateway to early access to working capital.

From Invoice Processing to Invoice Discounting

Traditional Accounts Payable ends once the payment is schedule. But enterprises no longer need to wait out long credit cycles before freeing up liquidity. Invoice discounting turns approved invoices into a financing opportunity, giving businesses faster access to working capital.

Instead of waiting until the due date, businesses can sell their approved invoices to financiers at a discount, giving them access to cash before the actual due date—without adding debt to the balance sheet.

With Mynd Fintech’s digital invoice finance solutions, companies can:

- Access liquidity faster – free up working capital without waiting for due dates

- Support suppliers – ensure timely vendor payments, strengthening the supply chain

- Improve cash flow predictability – enabling better planning and risk management

- Deploy capital for growth – channel freed-up funds into expansion and innovation

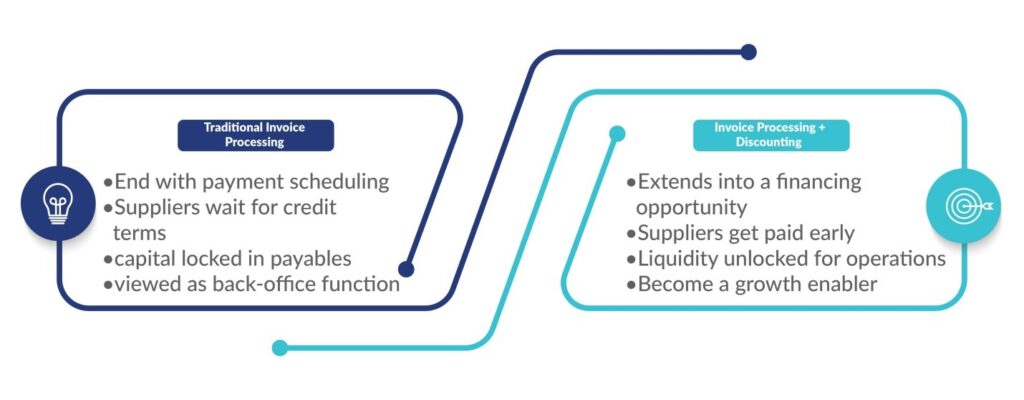

Invoice Discounting vs. Traditional AP

Traditional AP processes stop at payment scheduling. While efficient, they still leave capital locked until credit terms expire—limiting flexibility for both buyers and suppliers.

Invoice discounting, however, extends the AP process into a strategic financing opportunity. It bridges the gap between invoice approval and payment, unlocking liquidity that would otherwise remain tied up.

By shifting from AP model to a dynamic one with invoice discounting creates a more agile, enterprises gain financial agility, strengthen supplier networks, and position AP as a strategic partner in business growth.

How Mynd Fintech Supports Businesses

At Mynd Fintech, the focus goes beyond invoice processing. As a leading provider of working capital solutions, Mynd enables enterprises to leverage tailored financing options that optimize liquidity across the value chain.

Some of the key offerings include:

- Invoice Discounting – a short term borrowing unlock working capital by getting funds against unpaid invoices.

- Dynamic Discounting – optimize cash flow by negotiating early payments directly with suppliers at mutually beneficial terms.

- Vendor Finance – provide suppliers with access to financing on their invoices through financing partner ensuring steady cash flowwhile maintaining healthy buyer-supplier relationships.

- Factoring – monetize receivables quickly while transferring credit risk.

- Dealer Finance – support distribution channels with timely financing, ensuring smoother operations.

By integrating these solutions into their AP workflow, enterprises can convert what was once a cost-heavy process into a strategic lever for growth.

Best Practices for CFOs and Finance Leaders

To maximize value from invoice processing and related financing tools, finance leaders should:

- Digitize invoice intake – standardize invoice formats and centralize receipt channels to reduce manual errors.

- Adopt financing solutions early – explore AP process with solutions like invoice discounting or dynamic discounting to unlock liquidity before due date.

- Track AP metrics – such as average processing time, exception handling, and working capital unlocked.

- Strengthen supplier relationships – by offering early payment options through financing platforms.

- Integrate AP with treasury strategy – ensuring liquidity decisions are data-driven and proactive.

By adopting this practice, finance leaders can transform AP from a transactional function into a strategic driver of resilience, growth, and supplier confidence.

Why This Matters in today’s Environment

With global supply chains under pressure and credit cycles lengthening, enterprises can no longer afford inefficient cash management. Liquidity is not just a financial metric—it’s a competitive advantage.

Enterprises that can unlock cash quickly are better positioned to:

- Withstand short-term cash crunches

- Ensure continuity across supplier ecosystems

- Capture market opportunities quickly

- Grow sustainably without adding debt

Supply chain finance solutions give enterprises the flexibility to optimize working capital, strengthen supplier ecosystems, and build resilience against market volatility.

In this environment, AP is no longer just about “paying bills.” It’s about enabling agility and resilience.

Final Thoughts

For too long, Accounts Payable has been treated as a support function. In reality, invoice processing is the foundation of working capital optimization. When enterprises connect AP processes to financing solutions, businesses can transform liquidity management into a competitive advantage.

With its suite of working capital solutions—from invoice discounting to dynamic discounting, vendor finance, and dealer finance—Mynd Fintech partners with enterprises to transform AP from a cost center into a strategic growth enabler.