In today’s fast-paced business environment, access to timely working capital can make or break a company. Whether you’re running a growing startup or managing a mid-sized enterprise, cash flow gaps are inevitable. That’s where factoring services come into play.

Factoring is no longer just a financial tool for businesses in distress. It has evolved into a smart, strategic solution to unlock funds tied up in unpaid invoices. For many companies, especially those with long receivables cycles, factoring acts as a financial safety valve. But what is factoring really, and why is it becoming so important in financial planning today?

This blog takes a deep dive into the world of factoring finance. From understanding the concept and types, to seeing how it works in real businesses, we’ll explore everything you need to know about factoring in financial services.

The Concept and Nature of Factoring

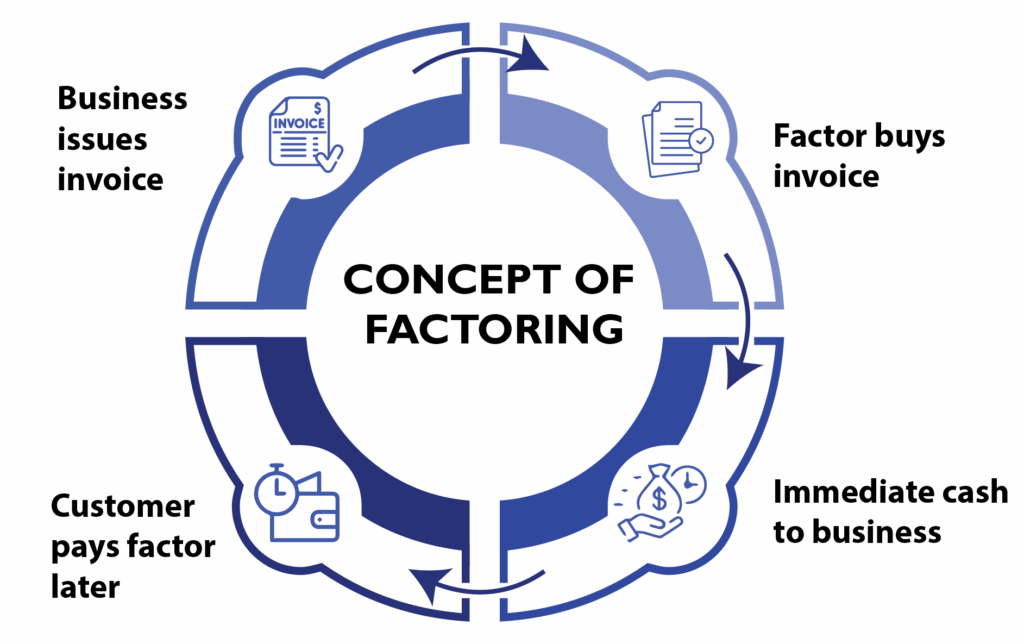

Factoring refers to a financial arrangement where a business sells its accounts receivable, or unpaid invoices, to a third party known as a factoring company. In exchange, the business receives immediate cash—typically up to 80 to 90 percent of the invoice value—while the factor collects the payment from the customer at a later date. This process improves cash flow without taking on debt.

The concept of factoring has existed for centuries, but its application in modern finance has gained momentum due to the increasing demand for quick liquidity. Factoring meaning in finance, is closely tied to how businesses manage their working capital and credit cycles. When businesses experience delays in customer payments, factoring acts as a bridge to keep operations running smoothly.

Factoring finance companies provide this service to help businesses reduce their credit exposure and turn receivables into working capital. It’s important to note that factoring is not a loan. It’s the sale of an asset—in this case, invoices. This distinction plays a significant role in how it affects balance sheets and financial health.

So when someone asks, what is meant by factoring, or requests a factoring finance definition, the most straightforward answer is: it’s a transaction where receivables are sold for immediate cash, improving liquidity and operational efficiency.

Types and Characteristics of Factoring

Now that we’ve covered the fundamentals, let’s explore the different types of factoring in financial services. Each type serves a different purpose depending on the business’s needs, customer reliability, and risk profile.

Types of Factoring

- Recourse Factoring

The business remains responsible if the customer fails to pay. The factor can recover the funds from the company. - Non-recourse Factoring

The factor assumes the credit risk. If the customer defaults, the business is not liable for repayment. - Disclosed Factoring

The customer is informed that their invoice has been assigned to a factoring company. - Undisclosed Factoring

The factoring arrangement is kept confidential, and the customer pays the business as usual. - Domestic Factoring

All parties—business, customer, and factor—operate within the same country. - International Factoring

Ideal for exporters. It involves multiple factors across borders to handle foreign receivables securely. - Co Factoring

Used in international trade, where one factor manages the seller’s side and another handles the buyer’s side to reduce risk and improve collections.

These types of factoring give businesses flexibility to choose solutions that best match their operations, markets, and customer behaviour.

Key Characteristics of Factoring

- Provides immediate working capital without incurring debt

- Transfers credit risk in non-recourse models

- Offers professional receivables management and collection services

- Shortens cash conversion cycles for better liquidity

- Can be tailored to domestic or international trade environments

- Does not impact ownership or equity like other financing methods

These characteristics of factoring make it a powerful financial strategy for businesses looking to improve cash flow and reduce dependency on traditional banking credit.

Functions and Importance of Factoring

Factoring plays a critical role in the financial management of a business, especially when navigating fluctuating cash flows and extended payment cycles. When we talk about the functions of factoring, we are referring to the various ways in which this financial tool supports business continuity and growth.

Core Functions of Factoring

- Working capital support

Factoring services provide immediate liquidity by converting receivables into cash, helping businesses meet operational expenses without waiting for customer payments. - Credit risk management

In non-recourse factoring, the factor assumes the risk of customer non-payment, giving businesses more confidence to offer credit terms. - Sales ledger management

Factoring companies often manage the entire receivables ledger, freeing up internal resources and ensuring timely collections. - Customer credit checks

Factoring firms assess the creditworthiness of your customers, allowing businesses to make informed sales decisions. - Collection and follow-up

Factors handle collections professionally, reducing administrative burden and improving efficiency specifically in non-recourse factoring.

These functions make factoring not just a financing tool but also a business process enabler.

Importance of Factoring

Understanding the importance of factoring is key to recognizing why more companies are incorporating it into their financial strategy. It ensures steady cash flow, especially in industries with long billing cycles. It also reduces reliance on loans, which can be harder to obtain and come with interest obligations.

Factoring in financial services is particularly valuable for businesses experiencing growth but lacking the reserves to fund larger operations. By turning receivables into immediate cash, factoring empowers businesses to pay suppliers on time, take on bigger orders, and maintain a healthy credit profile.

How Factoring Supports Different Industries

Factoring is not limited to a specific sector. Businesses across a variety of industries use factoring to unlock working capital and maintain financial stability. Some examples include:

- Manufacturing companies that use factoring to manage cash flow between production cycles and delayed distributor payments

- Exporters who depend on international and co-factoring models to reduce the risks of cross-border transactions

- Retailers and service providers that improve liquidity through disclosed factoring while maintaining transparency with their clients

In each of these cases, factoring services help businesses operate more efficiently, maintain healthy supplier relationships, and invest in growth with confidence. Beyond industry-specific use, factoring is also becoming a key element in broader financial strategy, helping businesses better manage cash flow, reduce credit risk, and support expansion goals.

Factoring in Financial Strategy and Management

When incorporated thoughtfully, factoring becomes more than a transaction. It becomes a part of financial planning. Factoring in financial management supports key goals like maintaining liquidity, reducing dependence on debt, and improving return on capital.

In fast-moving markets, businesses often face working capital gaps due to delayed payments. Factoring finance fills that gap without adding liabilities to the balance sheet. It allows financial managers to forecast more accurately and make strategic decisions with greater confidence.

Factoring in financial services is gaining popularity in India as businesses seek non-traditional forms of credit. With the government’s push for MSME support and digital finance, factoring is emerging as a preferred tool for both growth-stage companies and mature enterprises. Its role in cash flow optimization, particularly when tied into other financial technologies, makes it a strong pillar of modern financial management.

Choosing a Factoring Partner

While many businesses still assume that factoring is only offered by banks, the landscape has evolved. Banks do provide factoring, but fintech companies and independent factoring firms are now leading the charge with more flexible, technology-driven solutions.

Selecting the right factoring partner can make a significant difference in how effectively your business manages cash flow and customer relationships. The decision should be based on more than just pricing. It should take into account the partner’s ability to understand your business model, scale with your growth, and deliver reliable factoring solutions.

When evaluating a potential factoring company, here are a few key factors to consider:

- Industry expertise

A factoring partner that understands your sector will tailor services to your unique challenges and cash flow patterns. - Digital capabilities

Look for a factoring finance company that offers a seamless digital platform for invoice submission, tracking, and reporting. - Risk management approach

Especially in non-recourse factoring, understanding how the company assesses and manages customer credit is crucial. - Speed and transparency

Ensure the provider offers quick funding cycles and transparent fee structures without hidden charges.

One company that exemplifies this modern, tech-enabled approach is Mynd Fintech. Through services like invoice discounting, Mynd Fintech offers tailored factoring solutions for businesses of all sizes. Their platform-driven model simplifies onboarding, speeds up disbursals, and integrates smart credit assessment, helping businesses access liquidity without red tape.

For a closer look at why businesses choose Mynd Fintech and how their capabilities stack up, you can read this detailed overview Why Choose Mynd Fintech for Factoring?.

By choosing a reliable and forward-thinking partner, businesses can not only improve cash flow but also strengthen customer and supplier relationships through faster payments and better credit terms.

Common Misconceptions and Challenges

Despite its many advantages, factoring is sometimes misunderstood. These misconceptions can prevent businesses from taking full advantage of what is meant by factoring and the value it brings.

Let’s clear up some of the most common myths:

- Factoring is only for struggling businesses

In reality, factoring is widely used by healthy, growing companies that want to maintain steady cash flow without increasing debt. - It’s too expensive

While factoring fees exist, they are often comparable to or lower than the opportunity cost of delayed payments or missed business opportunities. - It affects customer relationships

Most professional factoring companies handle collections respectfully and transparently, maintaining the business’s reputation and client trust. - Factoring impacts credit ratings

Since factoring is not a loan, it does not typically affect the company’s credit score or add liabilities to its balance sheet.

Understanding the true nature of factoring allows businesses to make informed decisions. When used strategically, factoring in financial services can be an asset, not a compromise.

The Future of Factoring Services

The future of factoring is being shaped by technology, regulatory reforms, and evolving business needs. As more companies digitize their operations, the factoring business is also becoming smarter, faster, and more accessible.

Some emerging trends in factoring finance include:

- Blockchain-based invoice verification

This can help reduce fraud and streamline cross-border transactions, especially in international and co-factoring models. - Digital KYC and onboarding

Faster, paperless onboarding enables quicker access to funds and simplifies compliance for businesses. - Platform integration

Factoring companies are integrating with accounting and ERP systems, allowing real-time invoice sharing and cash flow tracking.

As MSMEs continue to adopt digital-first tools, factoring meaning in finance is expanding to include much more than just invoice purchases. It is evolving into a comprehensive working capital solution. Businesses that embrace these changes will be better positioned to manage growth, uncertainty, and competitive pressure.

Factoring as a Growth Lever

Factoring services are no longer just a financial afterthought. They have become a vital component of modern business finance, offering immediate liquidity, risk management, and operational flexibility. Whether you are a startup navigating cash flow gaps or an established business looking to fund large orders without adding to your debt, factoring can be a powerful growth enabler.

By now, you should have a clear understanding of factoring finance, its various types, and how it fits into broader financial management. You’ve seen the practical uses, the advantages it offers, and even the myths that surround it.

Factoring meaning in finance continues to expand, especially in markets like India, where businesses are rapidly embracing digital financial tools. It is not just a way to survive financial crunches—it is a proactive way to unlock your business’s full potential.

Understanding factoring services and how they align with your company’s goals can help you stay ahead of cash flow challenges and invest more confidently in your future.

FAQs

Q1. Can I use factoring even if I already have a business loan or credit line?

Ans. Yes, factoring is not a loan and does not interfere with existing credit facilities. In many cases, it can complement them by offering additional liquidity without increasing your debt load.

Q2. How quickly can I receive funds after submitting an invoice?

Ans. Most factoring companies process payments within 24 to 48 hours after invoice approval, though this may vary depending on your partner and onboarding status.

Q3. Is there a minimum turnover or invoice volume required to start factoring?

Ans. This depends on the provider. Some fintech-driven factoring finance companies offer services to small businesses with lower invoice volumes, while others may set thresholds.

Q4. Will my customer know if I use a factoring company?

Ans. That depends on the type of factoring you choose. In disclosed factoring, the customer is informed. In undisclosed models, the customer typically continues paying the business directly.

Q5. What kind of invoices are usually eligible for factoring?

Ans. Invoices issued to reputable, creditworthy businesses with clear payment terms are usually eligible. Most factoring companies avoid invoices that are disputed, overdue, or issued to individuals.