Cash flow is the lifeblood of any business. But even with healthy sales, companies can face liquidity issues when clients delay payments. This is where bill discounting steps in, helping businesses convert receivables into immediate working capital.

From helping small vendors meet immediate cash needs to enabling large enterprises to optimize their working capital, bill discounting is a proven tool that bridges the gap between receivables and real-time cash. It plays a pivotal role in trade finance and is increasingly being adopted by businesses looking for flexible, short-term credit options without the burden of traditional loans.

Whether you’re a large enterprise, an SME, or a vendor operating on credit terms, understanding the bill discounting meaning and its practical applications can help you unlock financial flexibility when it matters most.

Understanding Bill Discounting

Bill discounting, also referred to as invoice discounting, is a financing arrangement where a business sells its accounts receivable (bills raised to customers) to a lender at a discounted price. In doing so, the business receives immediate cash rather than waiting for the customer to pay on the due date.

This tool is potent in B2B transactions where goods or services are sold on credit. The bill discounting system ensures that businesses don’t have to halt operations or delay vendor payments while waiting for receivables to clear.

Bill Discounting Definition in Simple Terms

At its core, bill discounting involves three parties:

- The seller (draws the bill or raises the invoice),

- The buyer (who owes payment at a later date), and

- The financial institution (that advances payment after applying a discount.

It’s a win-win: sellers get liquidity, while lenders earn interest through the discount applied.

A Real Bill Discounting Example

Let’s say Company A supplies products to Company B on a 60-day payment term. Instead of waiting two months for the payment, Company A presents the bill of exchange to a financial institution. After assessing the bill’s authenticity and the buyer’s creditworthiness, the institution offers 70-90 percent of the invoice value upfront. This instant cash infusion helps Company A pay salaries, reinvest in inventory, or meet any short-term obligations.

This example shows how bill discounting can bridge cash flow gaps and support operational continuity. However, the specific structure of the arrangement can vary depending on who initiates the discounting, the nature of the bill, and the terms agreed upon. Let’s now explore the different types of bill discounting that businesses can leverage.

Types of Bill Discounting

There are various types of bill discounting, each tailored to different transaction structures, documentation practices, and business needs. Below are the most common ones:

- Clean Bill Discounting

Bills presented without any supporting documents fall under this category. Since there’s no collateral to validate the transaction, the risk is higher. Lenders typically require strong credit credentials or charge higher fees in such cases. - Documentary Bill Discounting

These bills are backed by trade-related documents like invoices, transport receipts, or bills of lading. The supporting paperwork makes the transaction more transparent and secure, which often results in more favourable terms for the seller. - Demand Bill Discounting

Here, the bill is payable by the buyer upon demand. These are commonly used in transactions that require immediate or same-day payment obligations. - Usance Bill Discounting

These carry a deferred payment term, such as 30, 60, or 90 days. The seller receives funds upfront, and the buyer pays the lender by the agreed maturity date. This is ideal for businesses managing longer credit cycles. - Vendor Bill Discounting

This model is designed to help vendors or suppliers receive early payments on invoices that buyers have already accepted. It supports smoother cash flow without requiring the buyer to pay early, making it a popular solution in supply chain financing. - Discounting of Bills of Exchange

A bill of exchange is a legally binding financial instrument often used in high-value domestic or international trade. When discounted, it allows the seller (or exporter) to access immediate funds while transferring the risk and collection process to the lender. This is a key component in global trade finance and helps exporters avoid delays in payment. - Purchase Invoice Discounting

Unlike traditional discounting, which is seller-led, purchase invoice discounting is buyer-initiated. In this model, the buyer receives early financing to pay suppliers, helping maintain healthy procurement cycles and often securing early payment discounts. - Purchase bill discounting

It is a similar concept where businesses seek funds against bills raised for purchases made on credit. Both solutions are designed to help businesses meet obligations without tying up cash reserves.

Bill Discounting Process and System

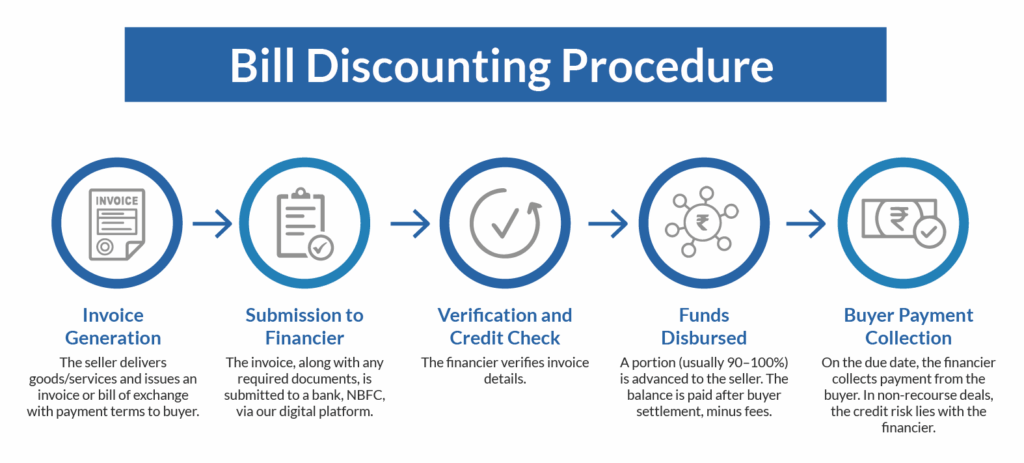

Understanding the bill discounting process helps demystify how businesses turn pending invoices into usable cash. While each lender may have slight procedural variations, the overall workflow tends to follow a standard format.

The Bill Discounting Procedure Step by Step:

- Raising the Invoice or Bill of Exchange

The process begins when the seller provides goods or services to a buyer and issues a bill of exchange or invoice with agreed payment terms (e.g., 30, 60, or 90 days). - Submission to a Financial Institution

The seller submits this invoice to a bank, NBFC, or a digital platform. In the case of documentary bill discounting, additional paperwork such as delivery receipts or purchase orders may also be required. - Verification and Credit Assessment

The institution verifies the invoice details and evaluates the buyer’s creditworthiness. This step is critical, as it directly impacts the discount rate and approval decision. - Discounting and Disbursement

Once verified, a percentage of the invoice is disbursed to the seller. The remainder (minus charges) is released once the buyer pays the full amount. - Collection from the Buyer

On the invoice due date, the financial institution collects payment directly from the buyer. In recourse arrangements, if the buyer defaults, the seller remains liable. In non-recourse discounting, the lender assumes the credit risk.

The Role of Technology in Modern Bill Discounting Systems

Gone are the days of slow, paper-based approval cycles. Today’s bill discounting systems are powered by automation, digital onboarding, and real-time tracking. From invoice upload to fund disbursement, much of the workflow is now digitized, reducing turnaround times and human errors.

These systems also allow businesses to monitor every stage of the bill discounting process, from approval to buyer payment. As invoice volumes grow and payment cycles vary, technology continues to play a vital role in streamlining operations, especially for companies managing hundreds of receivables at scale.

Benefits and Drawbacks of Bill Discounting

Like any financial tool, bill discounting comes with its own set of pros and cons. When used wisely, it can be a game-changer for working capital management. But understanding its limitations is equally important.

Key Advantages of Bill Discounting:

- Faster Cash Flow

Businesses get access to funds immediately rather than waiting for customers to pay. This is especially critical for SMEs with tight liquidity cycles. - Improved Working Capital

Freeing up locked receivables helps maintain operational continuity, paying suppliers, meeting payroll, or funding new orders. - No Collateral Required

In most cases, especially with invoice-based discounting, the bill itself acts as security. This makes it more accessible than traditional loans. - Strengthens Vendor and Buyer Relationships

In the case of vendor bill discounting or purchase invoice discounting, both parties benefit vendors get paid early, and buyers retain payment flexibility. - Enhances Financial Planning

Predictable cash inflow supports better budgeting, reinvestment, and business expansion strategies.

Potential Limitations and Risks:

- Interest Costs

The discounting fee is essentially interest. If margins are thin, this cost can eat into profitability. - Buyer Credit Risk

If the buyer defaults and the arrangement is on a recourse basis, the seller may be responsible for repayment. - Not a Long-Term Solution

While great for short-term cash needs, bill discounting isn’t designed for funding capital expenditure or long-term growth initiatives. - Dependency on Institutional Approval

Access to discounting depends on the buyer’s creditworthiness, not just the seller’s. This can be a hurdle for businesses dealing with less-established clients.

While the benefits of bill discounting are substantial, especially in terms of immediate liquidity and financial agility, businesses need to weigh these against the associated risks and costs. Companies should assess their margin structures, buyer reliability, and financing needs before opting in. When used strategically and with the right financial partner, bill discounting becomes more than just a short-term fix; it becomes a proactive cash flow management strategy that supports business continuity and sustainable growth.

Bill Discounting Facility in India

India’s dynamic business ecosystem, especially its thriving MSME and vendor networks, makes it an ideal environment for the growth of bill discounting facilities. Whether you’re a supplier, distributor, or large enterprise, access to flexible and quick financing options like bill discounting can significantly improve your financial agility.

The Regulatory Environment and Adoption

In India, discounting of bills in banking is a well-established practice, governed by RBI norms and banking regulations. Commercial banks, NBFCs, and fintech platforms all participate in providing this facility. The launch of TReDS (Trade Receivables Discounting System) by the RBI marked a turning point, enabling businesses, especially MSMEs, to discount invoices on a digital marketplace.

This has opened doors to greater financial inclusion, faster disbursals, and competitive rates, especially for smaller vendors who were traditionally underserved.

Digital Transformation in Bill Discounting

With the rise of tech-led platforms, the bill discounting system in India has evolved from slow, document-heavy procedures to real-time, API-enabled processes. Fintech companies like Mynd Fintech are at the forefront of this shift, offering tailored solutions such as:

- Vendor bill discounting: Ensures faster working capital for suppliers while maintaining buyer credit cycles.

- Purchase invoice discounting: Helps buyers manage large-scale procurement efficiently.

- Purchase bill discounting: Supports businesses that rely heavily on credit-based purchases.

These services are especially valuable for companies managing high invoice volumes or operating in long payment cycles. By digitizing approval workflows, tracking invoice lifecycles, and automating disbursements, platforms like Mynd Fintech make the bill discounting process seamless and scalable.

Making Bill Discounting Work for You

As businesses navigate tighter margins, evolving supply chains, and unpredictable payment behaviour, bill discounting stands out as a powerful tool to unlock trapped capital. It’s not just a liquidity solution, it’s a strategic enabler for business growth.

Whether you’re looking to improve procurement efficiency through purchase invoice discounting, optimize your vendor relationships, or tap into the benefits of discounting bills of exchange, having the right financial partner makes all the difference.

Mynd Fintech offers a robust suite of working capital solutions backed by smart technology and deep domain expertise. Their integrated approach ensures that your cash flow challenges are met with speed, transparency, and scalability.

If your business thrives on timely payments and predictable cash flow, now is the time to explore the right bill discounting solution for your needs.

Frequently Asked Questions (FAQs)

Q1: What is the difference between bill discounting and factoring?

Ans. While both help businesses access early payments against receivables, bill discounting involves discounting a bill of exchange, typically with recourse to the seller. Factoring, on the other hand, involves selling receivables to a third party (factor), who then manages collections and bears credit risk in many cases.

Q2: Why do some banks or NBFCs reject discounting applications?

Ans. Rejections usually stem from high-risk buyer profiles, incomplete documentation, or weak credit history of the seller. Some lenders also avoid working with newer businesses or those without established banking relationships.

Q3: How is the discount rate determined in bill discounting?

Ans. The discount rate is influenced by several factors: the creditworthiness of the buyer, the repayment period, market interest rates, and the lender’s internal risk assessment. Rates may be higher for longer tenures or high-risk buyers.

Q4: What’s the difference between recourse and non-recourse bill discounting?

Ans. In recourse discounting, the seller remains liable if the buyer defaults. In non-recourse discounting, the risk is transferred to the lender but this option usually comes with stricter eligibility and higher charges.

Q5: Can startups or early-stage businesses use bill discounting?

Ans. Yes, but eligibility largely depends on the buyer’s profile. If your startup supplies to a large or creditworthy company, many lenders will still offer a bill discounting facility, even if your credit history is limited.

Q6: What documents are typically required for bill discounting?

Ans. Generally, you’ll need a valid invoice or bill of exchange, proof of delivery, purchase order, KYC documents, and a signed agreement or acceptance from the buyer. Requirements may vary slightly between banks and fintech platforms.