For small and medium enterprises (SMEs), managing cash flow is one of the biggest challenges. Whether it’s securing capital to purchase inventory, investing in new equipment, or simply keeping day-to-day operations running smoothly, traditional financing options like bank loans often come with rigid requirements, long approval processes, and high interest rates.

This is where vendor financing steps in as a smart alternative. Vendor financing allows businesses to buy goods or services and pay for them over time, typically through deferred payments or extended credit terms offered directly by the supplier. This method not only relieves immediate financial pressure but also builds stronger relationships between businesses and their suppliers.

If you’re an SME looking for a flexible and sustainable way to finance your purchases, vendor financing can be a game-changer. Let’s look into its key benefits.

1. Better Cash Flow Management

One of the biggest advantages of vendor financing is that it helps businesses maintain liquidity. Instead of making full upfront payments for essential supplies, SMEs can spread out costs over a longer period. This allows them to:

- Allocate funds to other critical areas like marketing, payroll, or operational expansion.

- Reduce immediate financial strain while maintaining inventory and production.

- Plan and budget effectively without disrupting cash flow.

For SMEs that experience seasonal fluctuations in revenue, vendor financing ensures that working capital remains intact, providing stability even during low-revenue periods.

2. Easier Access to Capital

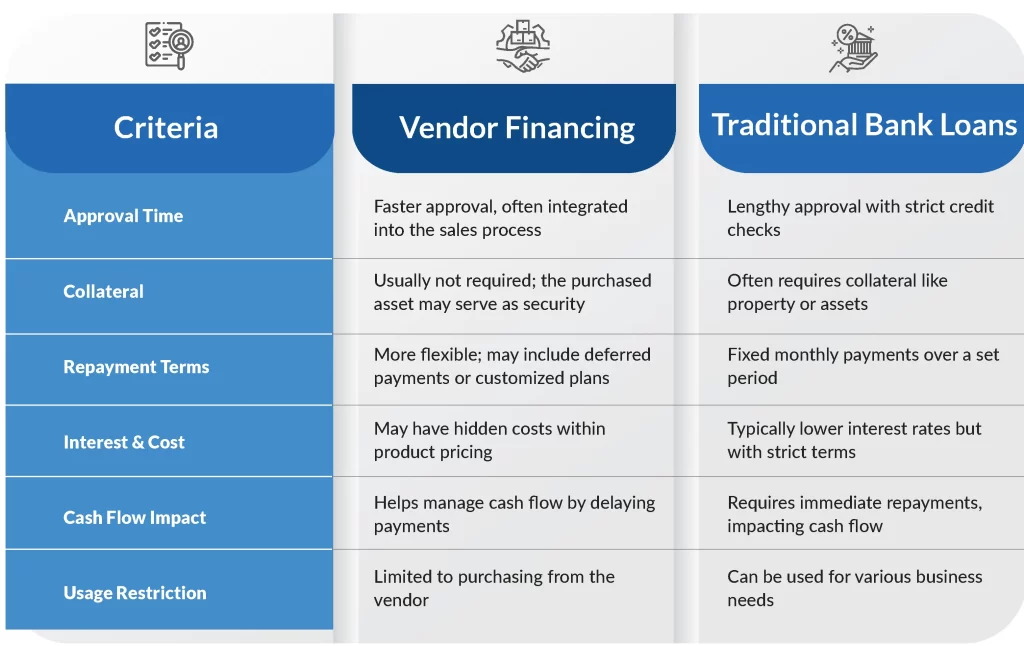

Traditional bank loans come with strict eligibility criteria, requiring high credit scores, collateral, and a lengthy approval process. Many SMEs struggle to meet these requirements, making vendor financing a more accessible alternative.

With vendor financing, businesses can:

- Obtain necessary supplies or equipment without waiting for loan approvals.

- Avoid the burden of high-interest loans or overdrafts.

- Build creditworthiness through timely payments to suppliers, improving future financing opportunities.

For businesses in their growth phase, this flexibility can make a huge difference in scaling operations without the stress of securing external funding.

3. Stronger Supplier Relationships

Trust is key in any business relationship, and vendor financing fosters long-term partnerships between SMEs and their suppliers. When a supplier extends credit, they demonstrate confidence in the business’s potential, leading to benefits such as:

- Preferential pricing and bulk purchase discounts.

- Priority access to high-demand inventory.

- More favourable payment terms over time as the relationship strengthens.

By consistently meeting payment commitments, SMEs can establish a reputation as reliable buyers, opening doors to better business opportunities.

4. Competitive Advantage and Business Growth

The ability to finance purchases over time allows SMEs to reinvest in growth. Instead of tying up capital in upfront payments, businesses can:

- Invest in larger inventory volumes, ensuring they can meet customer demand.

- Upgrade technology, equipment, or infrastructure without draining cash reserves.

- Expand operations or enter new markets more confidently.

Having access to vendor financing gives SMEs an edge over competitors who might be limited by cash flow constraints.

5. Lower Financial Risk

Financial stability is crucial for long-term success. Vendor financing reduces financial risk by:

- Lowering dependency on high-interest bank loans.

- Providing structured repayment plans that align with revenue cycles.

- Allowing businesses to retain ownership equity, unlike venture capital or investor funding.

Since repayment terms are often more flexible than traditional financing options, SMEs can manage their finances without unnecessary pressure.

Conclusion

Vendor financing is more than just a convenient payment method—it’s a strategic financial tool that can help SMEs thrive. From improving cash flow and easing capital access to strengthening supplier relationships and fuelling business growth, it offers a win-win solution for both buyers and suppliers.

If you’re an SME looking to optimize your finances while expanding your operations, consider exploring vendor financing. It could be the key to unlocking sustainable growth without the burden of heavy financial commitments.

FAQs

Q. Is vendor financing the same as a bank loan?

Ans. No, vendor financing is different from a bank loan. It is a credit arrangement between a business and its supplier, allowing the buyer to purchase goods or services on deferred payment terms. Unlike bank loans, vendor financing often does not require collateral or a long approval process.

Q. Do all suppliers offer vendor financing?

Ans. Not all suppliers provide vendor financing, but many do, especially in industries where long-term relationships are valuable. It’s always worth discussing financing options with your suppliers.

Q. Will vendor financing affect my credit score?

Ans. Yes, just like other forms of credit, vendor financing can impact your business credit score. Making timely payments can improve your creditworthiness, making it easier to secure financing in the future.

Q. Are there any hidden fees with vendor financing?

Ans. This depends on the supplier. Some may charge interest or late fees, while others may offer interest-free payment terms. It’s important to read the terms and conditions carefully before agreeing to vendor financing.

Q. How do I qualify for vendor financing?

Ans. Qualification requirements vary by supplier. Many vendors consider factors like your purchase history, business revenue, and financial stability rather than just your credit score. Some suppliers may request business references or financial statements.