As businesses adapt to a dynamic and competitive market, Supply Chain Finance (SCF) has become an essential tool for optimizing working capital and nurturing stronger supplier partnerships. SCF helps companies access liquidity by streamlining payments and offering flexible terms to buyers. However, with the shift toward digital platforms, data security concerns are growing. Business leaders, need to understand the potential risks and put robust measures in place to safeguard SCF transactions, ensuring that both operational efficiency and financial security remain intact.

The Rise and Benefits of Digital SCF Platforms for Businesses.

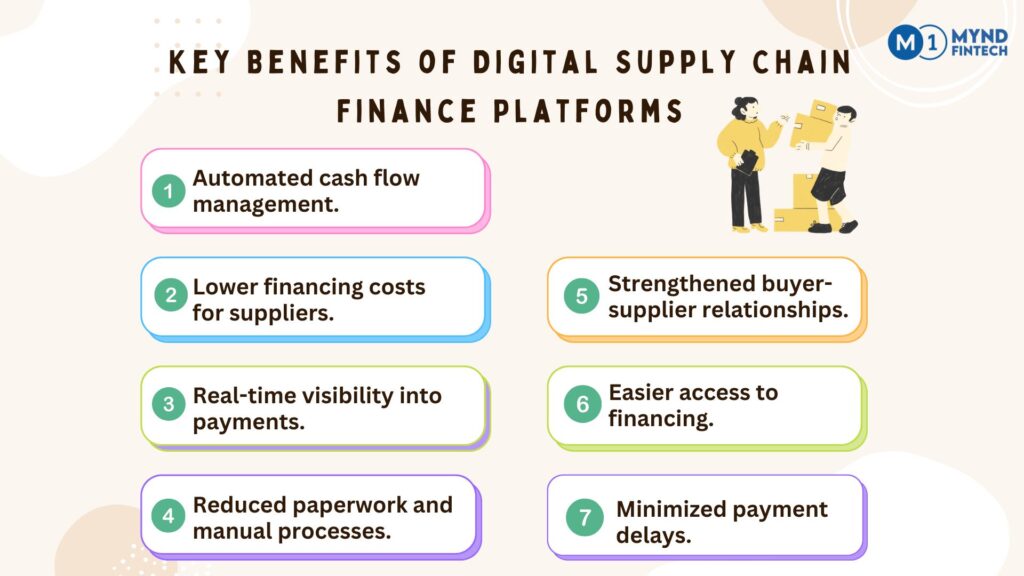

Supply Chain Finance allows companies to extend payment terms to suppliers while enabling suppliers to receive early payments from financiers, improving liquidity without disrupting the supply chain. This results in better cash flow management, lower financing costs for suppliers, and stronger relationships between buyers and suppliers. By using the buyer’s creditworthiness, suppliers can access early funds at reduced rates, minimizing financial stress.

With digital SCF platforms, these processes are automated, making transactions quicker and more transparent. Suppliers upload invoices, buyers approve them, and early payments are facilitated seamlessly. This not only reduces manual paperwork but also provides real-time visibility into cash flow and financial risks.

Key Benefits of Digital Supply Chain Finance Platforms

However, challenges persist. Many business owners struggle with adopting digital platforms, navigating technology integration, and digital platform threats. Let’s dive into the data security threats in supply chain finance.

Common Data Security Threats in Supply Chain Finance

The interconnected nature of Supply Chain Finance makes it particularly susceptible to data breaches. Some common threats include:

- Cyber-attacks on Financial Transactions: Hackers often target SCF platforms to intercept financial transactions, manipulate payment information, or commit fraud. This not only compromises sensitive data but also impacts the smooth flow of capital.

- Data Breaches: Unauthorized access to financial information stored on SCF platforms can lead to stolen data, affecting both businesses and their suppliers.

- Phishing Attacks: Cybercriminals may use phishing schemes to trick employees or suppliers into revealing sensitive information, allowing them to access SCF systems.

- Third-Party Vulnerabilities: SCF involves multiple parties, including suppliers, buyers, and financial institutions. A weak link in any third-party system could open the door to significant security breaches.

The Role of Technology in Enhancing Data Security in Supply Chain Finance

To combat the rising risks, technology plays a vital role in enhancing data security in Supply Chain Finance. Several advanced technologies are currently being deployed to protect sensitive financial data and avoid potential fraud:

- Blockchain Technology: One of the most promising solutions for securing SCF transactions is blockchain. Blockchain helps to keep a check for duplicate invoice so that same invoice cannot be discounted elsewhere.

- Encryption and Tokenization: These technologies safeguard financial data by transforming it into secure codes that can only be accessed with specific keys, making unauthorized access nearly impossible.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML help in real-time monitoring and detection of suspicious activities or anomalies in financial transactions, allowing businesses to react proactively to potential threats.

- Cloud Computing: Many SCF platforms use cloud solutions to manage data securely. Advanced cloud security protocols ensure that financial data is encrypted, backed up, and protected against unauthorized access.

Compliance Requirements for Financial Institutions and Businesses in Supply Chain Finance

Compliance refers to adhering to laws, regulations, and standards that govern financial transactions. In Supply Chain Finance, both financial institutions (like banks and NBFCs) and businesses must ensure that all processes—such as payments, and invoicing—comply with relevant regulations. These regulations are designed to protect the financial system, prevent fraud, and ensure transparency in financial transactions.

Key Compliance Requirements for Financial Institutions and Businesses

1- Know Your Customer (KYC) – KYC is a process where financial institutions verify the identity of their clients. This is essential to prevent money laundering, fraud, and financial crimes. Businesses participating in SCF must provide detailed information about their identity, ownership, and operations to financiers. This helps ensure that both parties are legitimate and trustworthy.

2- Anti-Money Laundering (AML) Regulations – AML regulations are designed to prevent money laundering and financial crimes by monitoring transactions and identifying suspicious activities. Financial institutions are required to track financial transactions within supply chains to ensure they are legitimate. Businesses must keep accurate records and report any unusual financial activities.

3- Data Security and Privacy- Regulations like the General Data Protection Regulation (GDPR) require businesses to protect customer and supplier data. This includes securing sensitive financial information and ensuring privacy is maintained. When using digital SCF platforms, it must ensure that all data shared with financial institutions or suppliers is secure and compliant with data protection laws.

Importance of Secure Integration between SCF Platforms and Enterprise Systems

- Data Accuracy and Consistency– When SCF platforms are integrated with a company’s internal systems, there is no need to manually input data. This reduces the chances of errors or discrepancies in financial records, ensuring that all transactions are accurate and consistent across systems. For business owners, this means better financial reporting, fewer mistakes, and improved decision-making.

- Enhanced Security and Compliance– Secure integration ensures that sensitive financial data is protected from unauthorized access. Modern SCF platforms use encryption and security protocols that safeguard the data being transferred between systems.

- Real-Time Visibility and Control– One of the biggest advantages of secure integration is the ability to have real-time visibility into the entire supply chain finance process. Business owners can monitor the status of invoices, payments, and financing options in real time, giving them better control over their working capital.

- Cost and Time Savings– Manual processes can be time-consuming and error-prone, leading to delays and higher costs. With secure integration, businesses can automate repetitive tasks such as invoice approvals, payment processing, and financing requests.

- Faster Access to Financing– For businesses facing financial constraints, getting quick access to financing is critical. Secure integration enables faster and smoother communication between the company and financial institutions.

Conclusion

As companies continue to rely on Supply Chain Finance optimize working capital and enhance supplier relationships, securing the financial transactions and has become a critical priority. Mynd Fintech offers a comprehensive and trusted digital supply chain financing platform that effectively addresses the challenges businesses face faced by MSMEs in accessing timely and affordable invoice financing. By acting as a digital marketplace, Mynd Fintech facilitates seamless collaboration between corporate, Vendors, Dealers, and Banks/NBFCs.

Focusing on easy and transparent financing solutions, Mynd Fintech streamlines supply chain finance processes, allowing businesses to confidently navigate the evolving landscape while maintaining the agility needed for sustainable growth.