In the world of business, maintaining a healthy cash flow is crucial for growth and sustainability. For B2B enterprises, cash flow management can be quite a challenge, especially when clients delay payments. In such situations, alternative financing options like invoice factoring become essential, providing quick liquidity to keep businesses afloat and ensure financial stability. But is invoice factoring the right choice for your B2B venture? Let’s explore this financing method in detail to find out.

What is Invoice Factoring?

Invoice factoring is a financial transaction where a business sells its accounts receivable (unpaid invoices) to a third party, known as a factor, at a discount. Instead of waiting for customers to pay their invoices, the business gets immediate cash from the factor, allowing them to address immediate financial, implement working capital solutions, or invest in business growth financing opportunities.

Imagine a furniture manufacturing company in India facing cash flow issues due to delayed payments from retailers. They sell ₹1,00,000 worth of unpaid invoices to a factoring company at a discount. The factoring company pays them ₹80,000 upfront (80% of the invoice value). After 60 days, when retailers pay, the factoring company deducts a fee (say 3%, ₹3,000) and returns the remaining balance (20% of the invoice value, ₹20,000) to the manufacturing company. This quick cash infusion helps the manufacturer cover expenses and invest in growth.

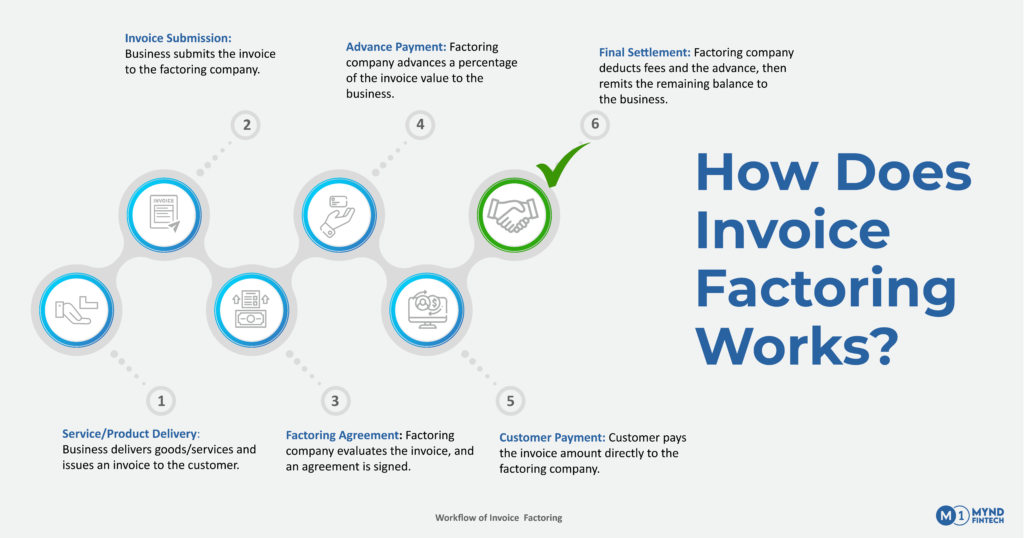

How Does Invoice Factoring Work?

When a business needs immediate cash flow, it sells its unpaid invoices to a factoring company. The factoring company typically pays a percentage (usually around 70-90%) of the invoice value upfront. Once the invoice is paid by the customer, the factoring company pays the remaining balance to the business, minus a fee for their service. This fee is usually a small percentage of the total invoice value.

Types of Invoice Factoring

- Recourse Factoring: In recourse factoring, the business remains liable for any unpaid invoices. If the customer fails to pay the invoice, the factoring company can reclaim the funds from the business.Imagine a garment manufacturer in India selling clothing to various retailers. They opt for recourse factoring to improve cash flow. They sell ₹2,00,000 worth of invoices to a factoring company at a discount. Later, one retailer defaults on a ₹50,000 invoice due to financial difficulties. In this case, the factoring company demands reimbursement from the garment manufacturer for the unpaid amount, as per the recourse agreement.

- Non-Recourse Factoring: With non-recourse factoring, the factoring company assumes the risk of non-payment. If the customer fails to pay due to insolvency or other specified reasons, the factoring company absorbs the loss, and the business is not held responsible.Consider a supplier of electronic goods in India choosing non-recourse factoring to mitigate risk. They sell ₹1,50,000 worth of invoices to a factoring company. Unfortunately, one customer declares bankruptcy, resulting in a ₹30,000 unpaid invoice. Since the agreement is non-recourse, the factoring company bears the loss, and the supplier is not required to repay the ₹30,000.

Benefits of Invoice Factoring

- For Sellers: Invoice factoring provides sellers with immediate access to cash by selling their unpaid invoices, enabling them to address urgent financial needs and focus on core business operations while minimizing the risk of non-payment through the assessment of buyer creditworthiness.

- For Buyers: Buyers benefit from invoice factoring by being able to negotiate extended payment terms with sellers, facilitating better cash flow management, and potentially accessing early payment discounts without depleting their own cash reserves, thus enhancing financial flexibility and strengthening business relationships.

- For Lenders: Invoice factoring offers lenders a reliable source of income through steady interest returns generated from advancing funds to sellers against their unpaid invoices, while also diversifying their portfolio and minimizing risk by assessing the creditworthiness of sellers and buyers, thereby ensuring the stability and profitability of their factoring operations.

Is Invoice Factoring Right for Your B2B Business?

- Assessing Your Business’s Cash Flow Needs: Before considering invoice factoring, it’s crucial to assess your B2B business’s cash flow Evaluate your ongoing expenses, payment terms with clients, and potential growth opportunities. If your business frequently experiences cash flow gaps due to delayed payments from clients, invoice factoring could be a viable solution to bridge these gaps and maintain financial stability, this makes it a crucial part of your cash flow solutions strategy.

- Evaluating the Risks and Benefits: Like any financial decision, it’s essential to weigh the risks and benefits of invoice factoring. Consider factors such as the cost of factoring fees, potential impact on customer relationships, and the flexibility offered by factoring compared to traditional financing options. While factoring provides immediate cash flow relief, it’s essential to ensure that the benefits outweigh the associated costs and risks for your business.

- Understanding the Application Process: Familiarize yourself with the application process for invoice factoring. Typically, you’ll need to provide details about your business, including financial statements, invoices, and customer information. The factoring company will assess the creditworthiness of your clients and determine the terms of the agreement. Understanding this process ensures a smoother transition to factoring and helps you prepare the necessary documentation.

- Comparing Invoice Factoring to Traditional Financing Options: Compare invoice factoring to traditional financing options like bank loans or lines of credit. Consider factors such as interest rates, repayment terms, and eligibility requirements. While traditional financing options may offer lower costs in the long run, they often come with stricter eligibility criteria and longer approval processes, unlike B2B financing options like invoice factoring that provide quick access to cash. Invoice factoring, on the other hand, provides quick access to cash without adding debt to your balance sheet, making it an attractive option for businesses with immediate cash flow needs. However, it’s essential to carefully evaluate both options to determine which best aligns with your business’s financial goals and circumstances.

Factors to Consider Before Opting for Invoice Factoring

- Terms and Conditions: Before opting for invoice factoring, carefully review the terms and conditions of the agreement. Pay close attention to factors such as the factoring fee, advance rate (the percentage of the invoice amount you’ll receive upfront), contract duration, and any hidden fees. Ensure that the terms align with your business’s needs and financial goals, and clarify any doubts or concerns with the factoring company before signing the agreement.

- Impact on Customer Relationships: Consider how invoice factoring may affect your relationships with customers. Some customers may perceive the involvement of a third-party factor as a sign of financial instability or view additional communication from the factoring company as intrusive. It’s essential to communicate transparently with your customers about the decision to factor invoices and reassure them that it won’t impact the quality of products or services provided. Maintaining strong customer relationships is crucial for long-term business success.

- Cost Analysis: Conduct a thorough cost analysis to determine the total expense of invoice factoring compared to the benefits it provides. Calculate the effective cost of factoring by considering the factoring fee, advance rate, and any other associated costs. This analysis is essential for effective working capital solutions. Compare this cost to the potential benefits, such as improved cash flow, reduced administrative burden, and access to immediate funds for business growth. Ensure that the benefits outweigh the costs before committing to invoice factoring.

- Flexibility and Scalability: Evaluate the flexibility and scalability of the invoice factoring arrangement. Assess whether the factoring company can accommodate your changing business needs, such as fluctuations in invoice volume or adjustments to payment terms. Look for factors like the ability to selectively factor invoices, flexible contract terms, and the option to increase or decrease funding as needed. A flexible and scalable factoring solution ensures that it can adapt to your business’s evolving requirements and support long-term growth initiatives.

How Mynd Fintech Simplifies Invoice Factoring

Get early payment for your goods or services by selling receivables to a financier, improving your cash cycle.

Key Features

- Unsecured Credit: No collateral needed.

- No Loans: Avoid traditional loan agreements.

- Tech Integration: Smooth ERP integration or use of Mynd Portal.

How It Works

- Credit Setup: Set limits based on buyer risk, with digital onboarding.

- Invoice Flow: Automated through ERP or manual upload.

- Disbursement: Invoices funded within 24 hours, directly to your bank.

- Repayment: Flexible payment options for buyers, automated NACH presentment.

Mynd Fintech’s invoice factoring service provides a reliable, flexible, and efficient solution to improve cash flow and reduce credit risk, allowing businesses to focus on growth without worrying about delayed payments. This service is aligned with comprehensive cash flow solutions and business growth financing strategies.

Conclusion

Invoice factoring can be a valuable tool for B2B businesses seeking to improve cash flow and mitigate credit risk. By understanding the intricacies of invoice factoring and carefully assessing its suitability for your business, you can make an informed decision that contributes to the long-term success and growth of your enterprise.