Working capital financing policies are crucial for businesses to manage their short-term financial needs effectively. These policies dictate how a company funds its day-to-day operations and ensures it has enough cash flow to cover expenses. By understanding the different types of working capital financing policies, businesses can make informed decisions to optimize their financial health. Join us as we explore the details of these policies, revealing practical advice to improve your financial well-being and promote sustainable growth.

Understanding Working Capital Financing

Working capital financing is like the fuel that keeps a business running smoothly every day, covering things like paying employees and buying supplies. It’s all about making sure there’s enough money available when needed. This financing ensures the company can handle its short-term bills and keep things going without any hiccups. There are different ways to get this money, like short-term loans or using credit lines, and businesses choose what works best based on factors like how much money they have and how quickly they need it. The goal is to find the right balance between having enough money to keep things going and not spending too much on borrowing. By managing this well, businesses can keep growing and stay financially healthy.

Types of Working Capital Financing Policies

The different types of working capital financing policies in simpler terms:

- Conservative Financing Policy: This policy focuses on safety and stability. Companies following this approach prefer to keep plenty of cash on hand and avoid taking on too much debt. They prioritize stability over rapid growth, making sure they have enough money to cover expenses even during tough times. While this strategy offers security, it might limit opportunities for expansion.

- Aggressive Financing Policy: On the flip side, an aggressive policy is all about chasing growth. Companies following this approach are willing to take on more debt to finance big projects or seize opportunities for rapid expansion. They prioritize growth over stability, aiming to maximize returns even if it means taking on more risk. While this strategy can lead to faster growth, it also comes with greater financial risk.Moderate Financing Policy: As the name suggests, a moderate policy strikes a balance between conservatism and aggression. Companies following this approach aim to grow steadily without taking on too much risk. They carefully manage their debt levels and invest in growth opportunities in a controlled manner. While this strategy may not lead to rapid growth, it offers a more stable and sustainable approach to financing.

Factors Influencing the Choice of Financing Policy

- Financial Situation: One of the biggest factors is the company’s financial health. If a company has a lot of cash on hand and strong profits, it might feel comfortable taking on more debt to finance growth. But if it’s struggling financially, it may need to be more conservative and focus on paying off existing debt.

- Industry Norms: Different industries have different expectations when it comes to financing. Some industries, like technology or biotech, may require significant upfront investment in research and development, leading to more aggressive financing strategies. Others, like utilities or consumer goods, may have more stable cash flows and prefer conservative financing approaches.

- Growth Opportunities: Companies with big growth opportunities may be more willing to take on debt to finance expansion projects or acquisitions. They see the potential for high returns and are willing to accept more risk in pursuit of those opportunities.

- Risk Tolerance: Every company has a different appetite for risk. Some are comfortable taking on a lot of debt to fund growth, while others prefer to play it safe and avoid taking on too much risk. This risk tolerance will influence the choice of financing policy.

- Regulatory Environment: Government regulations can also impact financing decisions. For example, certain industries such as banking and healthcare often face stricter borrowing regulations while sectors like renewable energy might have access to special financing programs and incentives.

- Market Conditions: Economic conditions and market trends can also play a role. In a strong economy with low interest rates, companies may be more willing to borrow money. But in a recession or when interest rates are high, they may be more cautious.

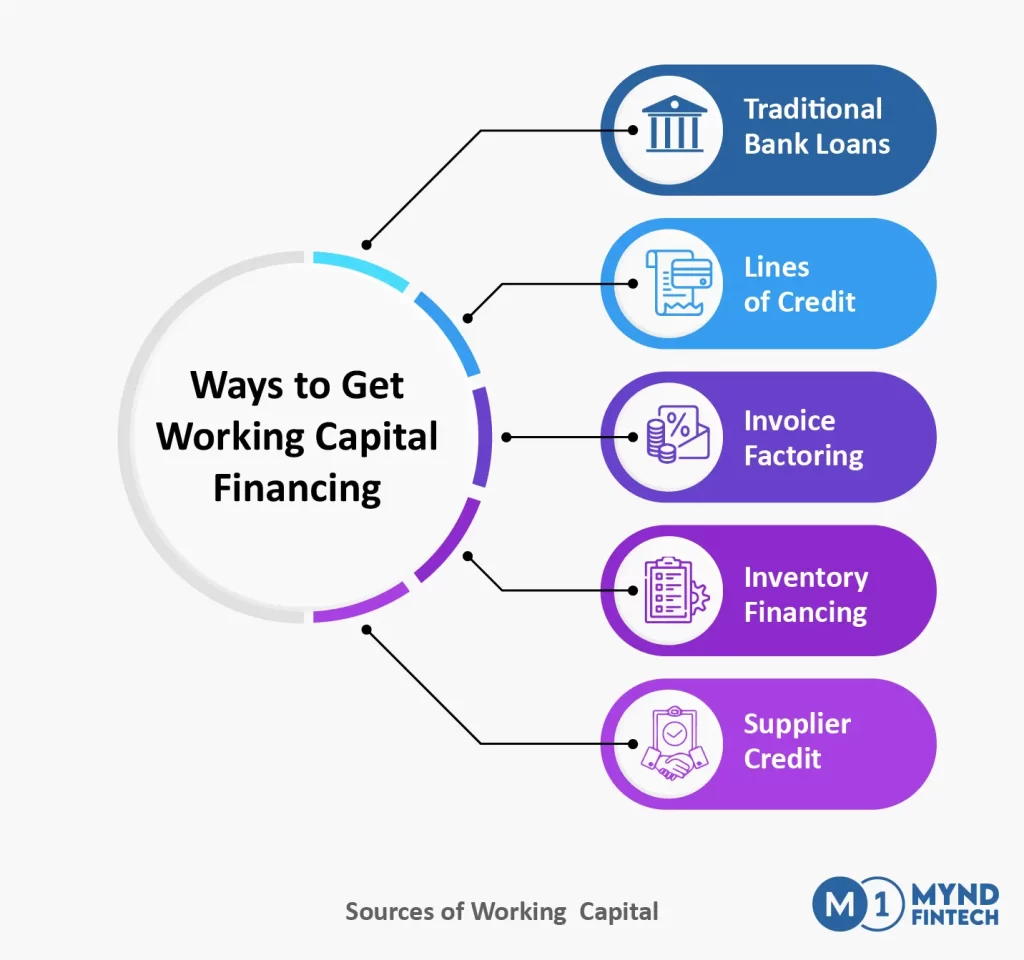

Ways to Get Working Capital Financing

- Traditional Bank Loans: One common way to get business cash flow solution is through traditional bank loans. Businesses can apply for a loan from a bank, and if approved, receive a lump sum of money which they repay over time with interest. These loans may require collateral, such as business assets or personal guarantees, to secure the funding.

- Lines of Credit: Another option is to secure a line of credit from a bank or financial institution. A line of credit gives businesses access to a predetermined amount of money that they can borrow as needed. They only pay interest on the amount they borrow, and once repaid, the funds become available again for future use.

- Invoice Factoring: Invoice factoring involves selling accounts receivable to a third-party company, known as a factor, at a discount. The factor advances a percentage of the invoice value upfront and collects payment from customers on behalf of the business. This provides businesses with immediate cash flow to cover expenses while waiting for customers to pay their invoices.

- Inventory Financing: Businesses with substantial inventory can use inventory financing to obtain working capital. This involves using inventory as collateral to secure a loan or line of credit. Lenders may advance funds based on the value of the inventory, allowing businesses to free up cash tied up in inventory to cover other expenses.

- Supplier Credit: Supplier credit, also known as trade credit, involves negotiating extended payment terms with suppliers. Instead of paying for goods or services upfront, businesses can defer payment for a set period, such as 30, 60, or 90 days. This allows businesses to preserve cash flow and use funds for other working capital needs. Effective use of supplier credit is crucial for risk management in financing.

Benefits of Working Capital Financing

- Smooth Cash Flow: Working capital financing ensures that businesses have enough cash on hand to cover day-to-day expenses like payroll, inventory purchases, and utility bills. This helps smooth out cash flow fluctuations and prevents disruptions in operations.

- Supports Growth: By providing access to additional funds, working capital financing supports business growth initiatives such as expanding operations, launching new products or services, or entering new markets. It gives businesses the flexibility to seize growth opportunities as they arise.

- Manages Seasonal Fluctuations: Many businesses experience seasonal fluctuations in demand or revenue. Working capital financing helps businesses manage these fluctuations by providing the necessary funds to cover expenses during slow periods and capitalize on opportunities during peak seasons.

How Mynd Fintech provides Financing

Mynd Fintech provides financing through a digital lending marketplace focused on enabling supply chain finance solutions. Acting as a bridge between anchor corporations, vendors, dealers, buyers, and banks/NBFCs. It offers various solutions like vendor finance, dealer finance, factoring, sales invoice finance, dynamic discounting, and purchase invoice discounting, empowering MSMEs with easy and quick funding via multiple lending partners. Mynd Fintech offers accessible and tailored financing options, supporting businesses in managing their working capital needs and driving growth in the dynamic marketplace.

Conclusion

Working capital financing policies play a critical role in shaping a company’s financial health and growth trajectory. By understanding the characteristics and implications of conservative, aggressive, and moderate policies, businesses can make informed decisions to optimize their working capital management.