In the ever-changing world of business, having enough money available to run your operations smoothly is crucial for keeping your company growing and stable. One way businesses manage their money is through vendor finance, which helps them handle their cash flow and make their day-to-day operations more efficient. In this guide, we’ll take a closer look at vendor finance: what it is, why it’s important, the different types available, the advantages it offers, how to put it into action, and what we can expect from it in the future. Let’s dive in!

Defining Vendor Finance: An Overview

Vendor finance is when businesses borrow money from their suppliers or other places to keep their cash flow healthy and their operations running smoothly. It’s like getting a helping hand from the companies you buy things from, so you can pay your bills on time and keep your business going strong.

For example, imagine a small bakery that needs flour to make bread. Instead of paying for the flour upfront, the bakery asks the flour supplier if they can pay later after selling the bread. This way, the bakery can use the money from selling the bread to pay for the flour. It’s like getting a loan from your suppliers to keep your business going!

The Crucial Role of Vendor Finance in Working Capital Management

Imagine you’re running a small retail store, and you need to stock up on inventory to keep your shelves full and your customers happy. However, you may not always have enough cash on hand to purchase all the inventory you need upfront. This is where vendor finance steps in to provide a solution.

Vendor finance allows you to work with your suppliers to negotiate payment terms that work for both parties. Instead of paying for inventory immediately upon delivery, you can arrange to pay for it at a later date, typically after you’ve sold the products in your store.

Vendor finance acts as a financial lifeline for businesses, especially small and medium-sized enterprises (SMEs), by providing them with the necessary funds to keep their operations running smoothly without putting undue strain on their cash flow. It allows businesses to maintain adequate inventory levels, fulfill customer orders, and ultimately drive revenue growth, all while effectively managing their working capital.

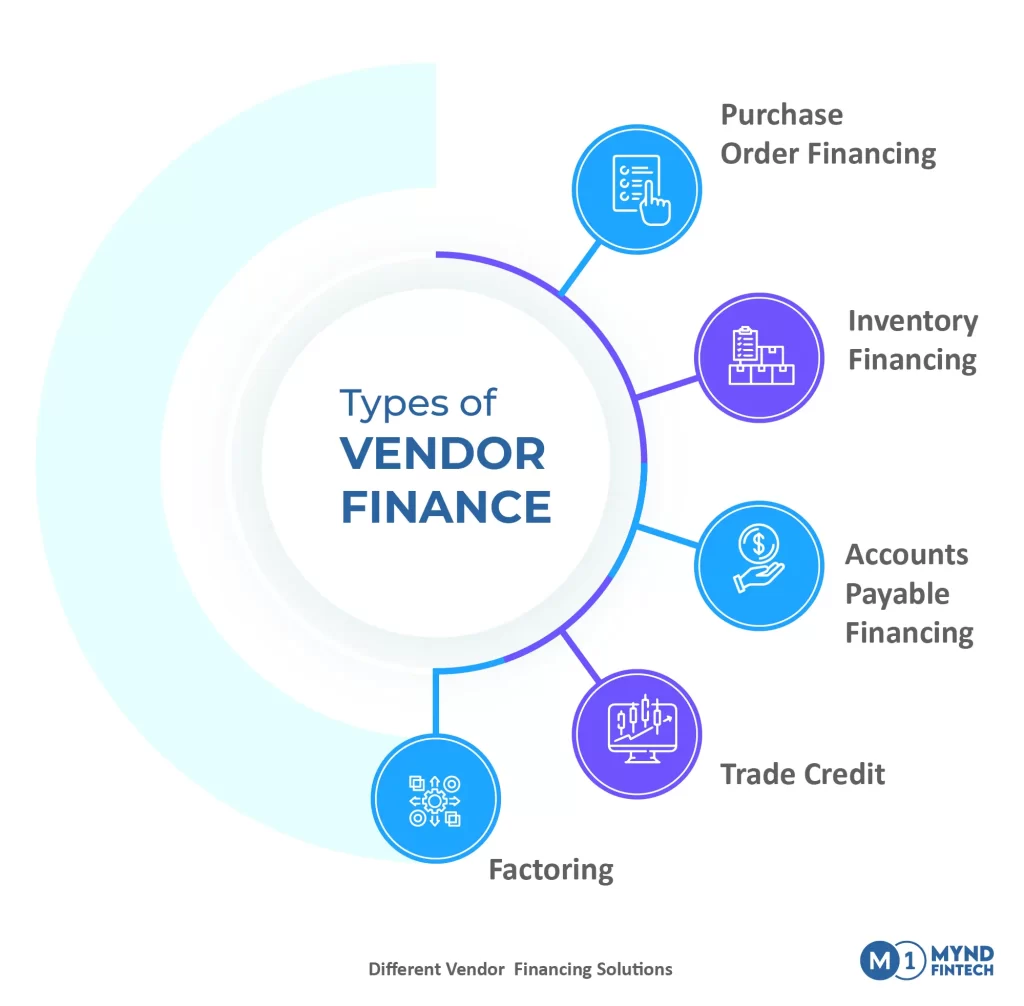

Types of Vendor Finance:

- Purchase Order Financing: This type of vendor finance helps businesses fulfill large customer orders, even if they don’t have enough cash upfront to buy the required inventory. Essentially, a financing company or lender provides the funds needed to purchase the inventory based on the customer’s purchase order. Once the order is fulfilled and the customer pays, the business uses the revenue to repay the financing company, along with any fees or interest.

- Inventory Financing: Inventory financing allows businesses to use their existing inventory as collateral to secure a loan or line of credit. This means they can borrow money based on the value of their inventory, which is often tied up in warehouses or on store shelves. By unlocking the capital tied in their stocks, businesses can access funds to purchase more inventory, expand their product offerings, or cover other expenses while waiting for inventory to sell.

- Accounts Payable Financing: With accounts payable financing, businesses can extend their payment terms with suppliers while still maintaining positive relationships. Instead of paying suppliers immediately, businesses can negotiate longer payment terms and use the extra time to generate revenue from sales before paying their invoices. This helps optimize payment cycles by aligning cash outflows with cash inflows, resulting in mutual benefits for both the business and its suppliers.

- Trade Credit: Trade credit is a common form of vendor finance where businesses buy goods or services on credit from their suppliers. The supplier extends credit terms, allowing the buyer to pay for the goods or services at a later date, typically within 30 to 90 days of the invoice date.

- Factoring: Factoring involves selling accounts receivable to a third-party financial institution, known as a factor, at a discount. The factor advances a percentage of the invoice value to the business upfront and collects payment from the customer on behalf of the business.

Benefits of Vendor Finance for vendors and buyers

Benefits for Vendors:

- Improved Cash Flow: Vendor finance allows vendors to receive payment sooner for their products or services, which helps improve their cash flow and provides them with the necessary funds to cover their own expenses, such as raw materials, production costs, and operational expenses.

- Increased Sales: By offering financing options to buyers, vendors can attract more customers and increase sales. Flexible payment terms make it easier for buyers to make purchases, leading to higher order volumes and revenue for vendors.

- Strengthened Relationships: Vendor finance fosters stronger relationships between vendors and buyers. By offering financing solutions tailored to buyers’ needs, vendors demonstrate their commitment to supporting their customers’ success, leading to increased loyalty and repeat business.

Benefits for Buyers:

- Improved Cash Flow Management: Buyer finance enables businesses to better manage their cash flow by extending payment terms with their vendors. This flexibility allows buyers to preserve working capital and allocate funds to other areas of their operations, such as marketing, expansion, or investment.

- Enhanced Purchasing Power: With access to financing options, buyers can increase their purchasing power and acquire larger quantities of inventory or higher-value products without depleting their cash reserves. This enables them to take advantage of bulk discounts, negotiate better pricing, and meet customer demand more effectively.

- Streamlined Operations: Vendor finance streamlines the procurement process for buyers by simplifying payment arrangements and reducing administrative burdens associated with managing multiple suppliers. This efficiency improves operational agility and enables buyers to focus on core business activities, such as sales and customer service.

Challenges and Solutions in Vendor Finance

Challenges:

- Cash Flow Constraints: One of the primary challenges in vendor finance is maintaining sufficient cash flow to meet payment obligations to suppliers while waiting for receivables from buyers.

- Risk Management: There’s a risk associated with extending credit to buyers, such as the risk of non-payment or delayed payment, which can impact the financial stability of vendors.

- Operational Efficiency: Managing the administrative tasks associated with vendor finance, such as processing invoices, tracking payments, and reconciling accounts, can be time-consuming and resource-intensive.

Solutions:

- Cash Flow Management: Implementing effective cash flow management practices, such as forecasting cash flow, optimizing inventory levels, and negotiating favorable payment terms with suppliers, can help alleviate cash flow constraints.

- Credit Risk Mitigation: Utilizing credit insurance, conducting thorough credit checks on buyers, and establishing clear credit policies and procedures can help mitigate credit risk and minimize the impact of non-payment or late payment.

- Automation and Technology: Leveraging automation and technology solutions, such as vendor finance software and electronic invoicing systems, can streamline processes, reduce errors, and improve efficiency in managing vendor finance operations.

How Mynd Fintech helps Vendors

Mynd Fintech provides vendors with accessible and efficient financing solutions to bolster their working capital and streamline their operations. By leveraging digital lending platforms and supply chain finance solutions, Mynd Fintech empowers vendors to unlock liquidity from their accounts receivable, optimize cash flow, and navigate cash flow challenges effectively. Mynd Fintech ensures that vendors have the financial support they need to thrive in today’s dynamic business environment.

Conclusion

In conclusion, vendor finance is crucial for managing working capital effectively. It helps businesses handle cash flow, strengthen relationships with suppliers, and grow. By using different vendor finance options, companies can overcome challenges and seize opportunities, ensuring long-term success in a changing market. Therefore, integrating vendor finance into business strategies is key for staying resilient, innovative, and prosperous.