Working capital is the lifeblood of any business, and in the B2B sector, it’s even more crucial. It ensures a company can pay its bills, keep operations running smoothly, and seize new opportunities. Mastering working capital management can drive growth, boost profits, and cut financial risks. In this blog, we’ll explore how B2B companies can fine-tune their working capital to supercharge their business growth.

Understanding the Working Capital

Working capital is a fundamental concept in finance and accounting that represents the difference between a company’s current assets and its current liabilities. In simpler terms, it’s the readily available cash and assets to cover its short-term financial obligations.

Working capital is essential for the day-to-day operations of a business. It ensures that a company can meet its short-term financial commitments, such as paying suppliers, covering payroll, and maintaining inventory levels.

Strategies for optimizing working capital include improving inventory management, streamlining accounts receivable and payable processes, negotiating favorable payment terms with suppliers, and forecasting cash flow accurately.

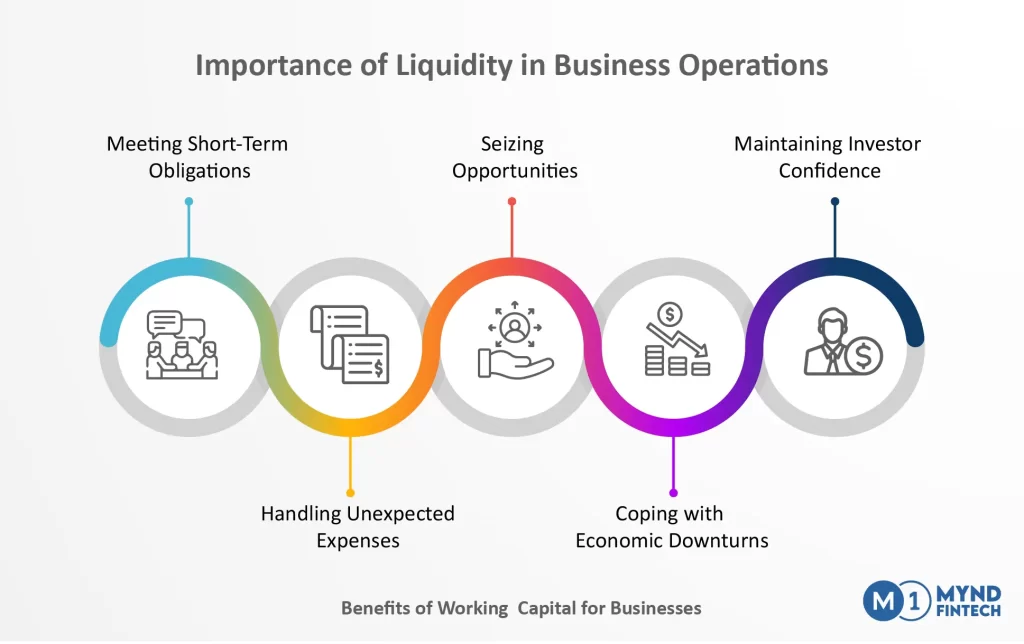

Importance of Liquidity in Business Operations

Liquidity in business operations refers to the availability of cash or assets that can be quickly converted into cash without causing significant loss in value. It’s like having readily accessible funds in your pocket rather than having all your money tied up in investments or assets that take time to sell.

Now, let’s explore why liquidity is crucial for businesses:

- Meeting Short-Term Obligations: Imagine you’re running a bakery and need to pay your suppliers for ingredients at the end of the month. Having sufficient liquidity means you can readily access cash to settle these bills without delay. This ensures smooth operations and maintains good relationships with suppliers.

- Handling Unexpected Expenses: Businesses encounter unexpected expenses all the time, whether it’s a broken equipment needing urgent repair or a sudden increase in utility bills. Liquidity acts as a safety net, providing the means to tackle these unforeseen costs without disrupting normal operations or resorting to expensive borrowing.

- Seizing Opportunities: Sometimes, great opportunities arise that require immediate action, such as a chance to purchase inventory at a discounted price or invest in a promising venture. Having liquidity allows businesses to capitalize on these opportunities swiftly, potentially yielding significant returns.

- Coping with Economic Downturns: Economic downturns or periods of low cash flow can pose challenges for businesses. Liquidity ensures they can weather these storms by covering operational expenses, retaining employees, and staying afloat until conditions improve.

- Maintaining Investor Confidence: Investors and stakeholders value liquidity because it signifies a company’s ability to handle financial obligations and adapt to changing circumstances. Businesses with strong liquidity positions are seen as more stable and attractive investments.

However, it’s essential to strike a balance when managing liquidity. By prioritizing liquidity management, businesses can enhance financial stability, build investor confidence, and thrive in dynamic environments.

Calculating Working Capital Requirements

To calculate your working capital requirements, you subtract your current liabilities from your current assets. The formula looks like this:

Working Capital = Current Assets − Current Liabilities

- Current Assets: These are assets that a company expects to convert into cash or use up within one year. Examples include cash, accounts receivable (money owed by customers), inventory (goods available for sale), and short-term investments.

- Current Liabilities: These are obligations that the company expects to pay off within one year. Examples include accounts payable (money owed to suppliers), short-term loans, and accrued expenses.

This calculation shows how much financial flexibility you have. If your working capital is positive, it means you have more assets than liabilities, which is generally a good sign. It means you have enough cash and assets to cover your short-term obligations.

However, if your working capital is negative, it means you may not have enough cash on hand to cover your immediate bills. This could be a red flag that you need to find ways to boost your cash flow or cut down on expenses.

Understanding your working capital requirements is essential for managing your finances effectively. It helps you plan for the future, make informed decisions about spending and investments, and ensure you have enough cash on hand to keep your business running smoothly.

Importance of Effective Working Capital Management for Business Growth

Effective working capital management is like having a well-oiled machine in your business operations. It’s all about making sure you have the right amount of cash and assets to keep things running smoothly without tying up too much money unnecessarily. Let’s delve deeper into why this is so crucial for business growth:

- Smooth Operations: Effective working capital management ensures you have enough cash flow to cover day-to-day expenses, keeping operations running smoothly and customers satisfied.

- Seizing Opportunities: With optimal working capital, you’re poised to seize growth opportunities swiftly, whether it’s expanding product lines, entering new markets, or acquiring competitors.

- Managing Cash Flow: By optimizing cash inflows and outflows, you maintain a healthy cash flow, preventing shortages and enabling accurate forecasting.

- Minimizing Financing Costs: Efficient management reduces excess inventory, negotiates favorable payment terms, and explores alternative financing, freeing up capital for strategic investments.

- Building Investor Confidence: Strong working capital management signals stability and reliability, attracting investors and stakeholders confident in your ability to weather challenges and fuel growth.

Analyzing Working Capital Trends

- Industry-Specific Insights: Different industries have different working capital needs. For example, a retail business might have higher inventory levels than a service-based company. Analyzing working capital trends within your industry helps you understand what’s normal and identify areas where you might need to adjust your strategy.

- Spotting Seasonal Patterns: Many businesses experience fluctuations in working capital throughout the year due to seasonal changes in demand or sales cycles. By analyzing these patterns, you can anticipate when you might need extra cash on hand or when you can expect a surplus, allowing you to plan accordingly.

- Identifying Cyclical Trends: Economic cycles can also impact working capital trends. During economic downturns, businesses may struggle with cash flow and need to tighten their belts. Conversely, during periods of growth, they may have more cash to invest in expansion. By recognizing these cycles, you can adapt your working capital strategy to suit the prevailing economic conditions.

- Benchmarking Against Competitors: Comparing your working capital performance to that of your competitors provides valuable insights into how you stack up in the market. If you consistently have lower working capital than your peers, it could indicate inefficiencies in your operations or missed opportunities for improvement. Conversely, if you outperform your competitors, it could be a sign of a well-managed business.

Strategies for Optimizing Working Capital

Optimizing working capital is like fine-tuning your finances to ensure you’re using your money wisely and efficiently. It involves managing your cash flow, inventory, and accounts receivable and payable in ways that maximize your resources and minimize waste. Take a look at some strategies:

- Inventory Management: Keeping too much inventory ties up cash that could be better utilized elsewhere. Adopting techniques like just-in-time inventory, where you only order what you need when you need it, helps minimize excess inventory and free up cash.

- Accounts Receivable Optimization: Getting paid promptly is crucial for maintaining healthy cash flow. Implementing efficient invoicing processes, offering incentives for early payment, and following up on overdue accounts can help speed up receivables and improve liquidity.

- Accounts Payable Optimization: On the flip side, delaying payments to suppliers without harming relationships can provide a short-term boost to cash flow. Negotiating favorable payment terms, taking advantage of early payment discounts, and prioritizing payments based on cash availability can all help optimize accounts payable.

- Cash Flow Forecasting: Accurate cash flow forecasting allows you to anticipate cash shortages or surpluses and plan accordingly. By projecting your cash needs and sources over a specific period, you can identify potential gaps or excesses and take proactive steps to address them.

- Technology Adoption: Leveraging technology tools like accounting software, inventory management systems, and electronic payment platforms can streamline processes, improve accuracy, and reduce administrative costs, ultimately contributing to better working capital management.

- Supplier Relationships: Building strong relationships with suppliers can lead to more favorable payment terms, discounts, and priority access to inventory. By cultivating open communication and fostering trust, you can negotiate terms that benefit both parties and improve working capital efficiency.

- Continuous Improvement: Working capital optimization is an ongoing process that requires regular monitoring and adjustment. By establishing key performance indicators (KPIs), tracking progress, and identifying areas for improvement, you can continuously refine your strategies and adapt to changing circumstances.

How Mynd Fintech Helps in Managing Working Capital

Mynd Fintech offers a range of innovative solutions to help businesses effectively manage their working capital. Through our digital lending marketplace, we facilitate seamless supply chain finance solutions, empowering MSMEs with quick and easy funding options. Our tailored solutions include Vendor Finance, Dealer Finance, Factoring, Sales Invoice Finance, Dynamic Discounting, and Purchase Invoice Discounting. By leveraging our platform, businesses can unlock locked-in receivables early, improve cash flow, and optimize working capital efficiency. Take control of your finances and fuel your business growth with Mynd Fintech today! Visit- myndfin.com to learn more and get started.

Conclusion

Mastering working capital is essential for sustainable growth and resilience in today’s dynamic business environment. By understanding the significance of working capital, embracing liquidity as a strategic asset, and implementing effective management practices, businesses can navigate challenges, seize opportunities, and thrive in the long run. With careful analysis, strategic planning, and disciplined execution, working capital becomes not just a financial metric but a driver of success.