What is Permanent working capital?

Permanent working capital is like the financial foundation of a company’s everyday activities. It’s the minimum amount of money a business needs to keep on hand for its regular operations. This money is called “permanent” because it’s always necessary, no matter if sales are up or down.

Why It’s Important for Businesses:

- Keeps Things Steady: Permanent working capital makes sure a company always has enough money to handle its usual bills and pay employees. This stability is crucial.

- Smooth Operations: Without enough permanent working capital, a business might struggle to work well. It helps keep everything running smoothly and ensures the company can meet its financial commitments without any hitches.

- Covers Basic Costs: It’s also important for paying regular expenses like rent, utilities, and salaries. Plus, it supports keeping enough products in stock and letting customers buy on credit.

Examples of Current Assets Considered as Permanent Working Capital:

Permanent working capital usually includes these types of current assets:

- Cash: Some money in hand or in the bank for urgent needs.

- Accounts Receivable: The money owed by customers for what the company sells. It helps keep a steady flow of cash.

- Inventory: Keeping products in stock to meet customer demands.

These assets together make up the permanent working capital that businesses need to work well and stay financially stable.

What is the Permanent Working Capital Formula?

Calculating permanent working capital is essential for businesses to determine the baseline level of current assets required for smooth and consistent operations. The formula for permanent working capital is as follows:

Permanent Working Capital = Minimum Current Assets – Minimum Current Liabilities

Here’s an explanation of the components of this formula:

Minimum Current Assets: These are the basic assets a business always needs, like cash, money owed by customers, and stock. They’re the least amount of assets required to pay bills, keep enough products, and stay financially stable.

Minimum Current Liabilities: These are the basic debts a business always has to pay, like what it owes to suppliers, short-term loans, and other short-term debts. They’re the essential financial responsibilities to keep the business running.

Determining the Minimum Current Assets and Liabilities:

To determine the minimum current assets and liabilities, businesses should conduct a thorough analysis of their historical financial data and operational requirements. Here’s how to do it:

- Review Historical Data: Examine past financial statements and cash flow data to identify the minimum level of current assets required to cover expenses during the slowest periods.

- Analyze Liabilities: Determine the minimum current liabilities that need to be settled during the same period. These might include routine expenses and any short-term debts that come due.

- Consider Seasonal Variations: If your business experiences seasonal fluctuations, adjust your calculations accordingly to ensure that you have enough permanent working capital during slower seasons.

What is Temporary Working Capital?

Temporary working capital is the extra money a company might need for short-term changes in its business. It’s like a safety net for sudden increases in money going in and out. It’s needed for things like handling sudden high demand, dealing with seasonal changes, special projects, or unexpected expenses. Unlike permanent working capital, it’s not something a business needs all the time, just for a little while.

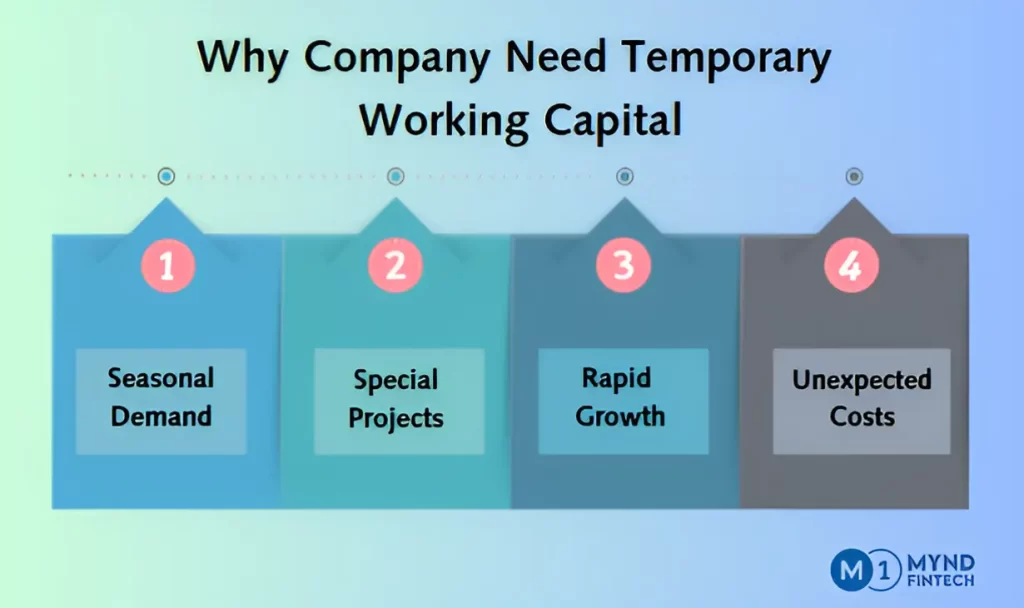

When and Why a Company Might Need Temporary Working Capital:

Companies might need temporary working capital for different reasons:

- Seasonal Demand: Some businesses have busier times during the year, like the holidays. They might need extra money for more products and hiring more staff.

- Special Projects: If a company is doing special things like launching new products, big marketing campaigns, or research projects, they might need more cash for these projects.

- Rapid Growth: When a business is growing quickly, it might need more money to cover unexpected costs and meet the higher demand from customers.

- Unexpected Costs: Sometimes, sudden expenses like fixing equipment or paying for legal stuff can strain a company’s money. Temporary working capital helps cover these costs without messing up regular operations.

Examples of Situations Requiring Temporary Working Capital:

-

- Construction Company: A construction company doing a big project might need extra cash for things like materials, workers, and equipment at the start of the project. Once the project’s done, they won’t need as much extra money.

- Agricultural Business: Farms often need more money to buy things like seeds, fertilizers, and labor during planting and harvest times. They don’t need as much extra cash the rest of the year.

- Retailer: A store selling stuff that’s popular at certain times of the year might need extra money to stock up before those busy times, like back-to-school or the holidays.

- Tech Startup: A new tech company that lands a big contract might need more cash to hire more people and get what they need to finish the project. They won’t need as much extra money once the project’s done.

What is the Temporary Working Capital Formula?

Calculating temporary working capital is essential for businesses to determine the additional funds required to manage short-term fluctuations in working capital needs. The formula for temporary working capital is as follows:

Temporary Working Capital = Actual Current Assets – Permanent Working Capital

Here’s an explanation of the components in this formula:

Actual Current Assets:

These are the current assets a business currently holds, including cash, accounts receivable, inventory, and any other short-term assets. Actual current assets represent the real-time financial resources available to the company at a specific point in time.

Permanent Working Capital:

As discussed earlier, permanent working capital is the baseline level of current assets needed for ongoing operations. It is calculated using the formula: Permanent Working Capital = Minimum Current Assets – Minimum Current Liabilities.

Difference Between Permanent and Temporary Working Capital

Understanding the Difference Between Permanent and Temporary Working Capital:

- Purpose:

- Permanent Working Capital: This is the money needed to run a business every day. It covers regular costs and keeps enough cash to handle ongoing bills.

- Temporary Working Capital: It’s used for short-term needs like seasonal demand or unexpected costs.

- Stability:

- Permanent Working Capital: Stays pretty much the same and is predictable over time.

- Temporary Working Capital: Changes a lot because it’s linked to short-term events, making it less stable.

- Where the Money Comes From:

- Permanent Working Capital: Usually funded with long-term sources like investments, profits, and long-term debt.

- Temporary Working Capital: Often funded with short-term sources like short-term loans, lines of credit, and trade credit. It matches the temporary needs.

How to Manage Permanent and Temporary Working Capital

Managing both permanent and temporary working capital is crucial for maintaining financial stability and flexibility in your business. Here are strategies for effective management of these two forms of working capital:

Managing Permanent Working Capital:

- Optimize Cash Flow: Efficient cash flow management is vital. Ensure that your accounts receivable are collected promptly and that you extend credit wisely. Simultaneously, manage accounts payable by negotiating favorable terms with suppliers.

- Inventory Control: Maintain a lean inventory to free up cash that might be tied up. Implement just-in-time inventory systems to reduce carrying costs.

- Reevaluate Credit Policies: Review your credit policies to ensure they strike a balance between providing customer flexibility and maintaining steady cash flow.

- Long-term Financing: Use long-term financing sources, such as equity, retained earnings, and long-term loans, to fund permanent working capital. This aligns the financing with the consistent nature of these needs.

Managing Temporary Working Capital:

- Predict: Make good guesses about when your business will need extra cash for busy or special times. Look at past info and what’s happening in the market.

- Money on Hand: Get short-term money solutions, like lines of credit or short-term loans, to deal with temporary money needs. These options are flexible and give you cash when you need it.

- Save Up: Save some of the money you make during the best times to have a backup fund for when things slow down.

- Talk to Suppliers and Customers: If you know you’ll need more stuff or if you might take longer to deliver because of higher demand, tell your suppliers and customers so they can prepare

- Plan Your Stuff: Be careful about how much stuff you keep in stock. Have some extra for busy times, but don’t keep too much to avoid extra costs.

Role of Financial Instruments in Managing Temporary Working Capital:

Financial tools like short-term loans, lines of credit, and trade credit are important for handling temporary working capital:

- Short-term Loans: You can use these loans to cover money gaps when you have increased expenses or unexpected costs. They give you the cash you need and can be paid back when your temporary money needs ease up.

- Lines of Credit: Lines of credit are a flexible way to get money for temporary working capital. You can use the credit when you need it and only pay interest on what you use.

- Trade Credit: Make deals with suppliers to get good payment terms, so you can delay payments when you need extra cash for temporary working capital. It helps you manage your money better.

Conclusion:

Now that you have a better understanding of the difference between permanent and temporary working capital, you might be wondering how to optimize your working capital for your business’s unique needs. That’s where Mynd Fintech comes into play.

At Mynd Fintech, we specialize in helping businesses manage their working capital effectively. Our team of financial experts can assist you in determining the right balance between permanent and temporary working capital, ensuring that your business has the financial stability it needs to thrive. We offer a range of financial solutions and strategies tailored to your specific requirements, whether it’s optimizing your cash flow, reducing excess inventory, or improving your accounts receivable turnover.

Don’t let working capital management become a puzzle for your business. Contact Mynd Fintech today and take the first step towards achieving financial stability and success. Our experienced professionals are ready to provide you with personalized financial guidance, empowering your business to grow and prosper.

To get started, simply reach out to us through our website or give us a call. Your business’s financial health is our priority, and we look forward to helping you achieve your goals.

FAQs

Q. How is permanent working capital calculated, and why is it essential for business stability?

Ans. Explore the formula for determining permanent working capital and its role in maintaining financial stability and smooth daily operations.

Q. What are the common financial tools businesses use to manage temporary working capital effectively?

Ans. Discover the benefits of short-term loans, lines of credit, and trade credit in managing fluctuating cash flow needs.

Q3. What is the difference between permanent and temporary working capital?

Ans. Learn how permanent working capital ensures consistent business operations while temporary working capital supports short-term needs like seasonal demands or unexpected expenses.

Q. How can Mynd Fintech help businesses optimize their working capital management?

Ans. Mynd Fintech offers tailored solutions to improve cash flow, enhance liquidity, and reduce costs through tools like dynamic discounting and real-time analytics. We streamline inventory management with demand forecasting and optimize accounts receivable through faster collections and credit risk assessments. Our integrated supply chain financing and working capital loans ensure seamless financial support.

Read More: