Working capital management is an integral business process that helps companies make effective use of their current assets. It aims at ensuring better optimisation of cash flow by meeting short-term financial obligations and expenses, thereby maximising operational efficiency. Proper working capital management lets companies free up the cash so that they can reduce external borrowing, fund mergers or acquisitions or invest in R&D.

What is Working Capital Management?

Working capital management is the process through which an organisation plans to utilise its current assets and current liabilities in the best possible manner. It helps businesses run and manage their regular operations by making routine payments and optimising the smooth performance of business operations.

What is Working Capital?

Working capital signifies the liquidity levels of businesses in order to manage day-to-day expenses. It is calculated by subtracting current liabilities from the current assets.

Working Capital = Current Assets – Current Liabilities (Given as per the company’s Balance sheet)

Here, current assets mean the money kept in a bank and also the assets that can be converted into cash if any situation arises. While the liabilities represent debt that an individual will have to pay within the prescribed year.

Broadly, we can say that working capital is used to measure the company’s overall financial health. When the difference between what a company owns is larger, the business will be considered healthier. But if the company owes more, then there will be negative working capital.

Understanding Working Capital Management

The primary purpose of working capital management is to enable the company to maintain sufficient cash flow and meet its short-term operating costs and short term debt obligations. Here, current assets include anything that can be easily converted into cash within 12 months like – accounts receivables and inventory (raw material, work-in-progress and finished goods).

While current liabilities are any obligations due within the following 12 months. These mainly include debt payments and accruals for operating expenses.

The takeaway is that working capital management helps improve a company’s cash flow management and earnings quality by using its resources efficiently.

Importance of Working Capital Management

Working capital management is significant in financial management as it plays a vital role in meeting day-to-day immediate debt obligations and keeping the business running steadily. Here are the advantages of working capital management:

Let’s have a look at the benefits of working capital management:

- Working capital management helps fund the day-to-day operating of a company and meet short-term obligations.

- It also helps foster business growth without incurring debt.

- By managing working capital, organisations ensure that adequate cash levels are available to meet any unanticipated scenario.

- Optimum use of working capital management maintains a ‘safety net’ that helps protect against delays in payments.

Objectives of working capital management

Working capital management is a financial strategy that helps companies invest their resources productively. Its objectives include:

- To maintain the smooth operation of a business from the acquisition of the raw material to the seamless production and delivery of the end products.

- To keep the cost of capital at a minimal level. The management must negotiate well with the financial institutions and select the right mode of finance.

- To maximise return on current assets investments. This means that the rate of return earned due to investments in current assets must be more than the interest used for financing the current assets.

- To maintain the optimal level of working capital. A delay in any activity from buying raw materials to the customer making the payment, would be costly to the business and directly impact the profit margins.

Working Capital Ratios

The working capital ratio is a measure of liquidity, signifying whether a company can pay its obligations or not.

Let’s understand the different types of working capital ratios:

1. Inventory Turnover Ratio: Inventory turnover measures how efficiently a company uses its inventory by comparing the cost of goods sold with the average inventory for a period. It indicates how many times the average inventory is sold during a period.

Inventory Turnover Ratio = Cost of goods sold / Average inventory at a selling price

2. Average Collection Period Ratio: Average collection ratio is the average amount of time a business takes to collect its receivables. This ratio helps businesses plan their expenses in advance by predicting the cash flow from their accounts receivable.

Average Collection Period Ratio = 365 Days/Average Receivable Turnover Ratio

3. Current Ratio: The current ratio is the liquidity ratio that measures the company’s capability to pay off its short-term, liabilities and obligations. This ratio is important for investors and analysts as they indicate how well the company is capable of optimising its current assets mentioned in the balance sheet.

Current Ratio = Current Assets/Current Liabilities

Factors that affect Working Capital Needs

It is essential to have an optimum quantity of working capital to run a business and meet day-to-day needs. Factors affecting working capital needs are given below:

(i) Scale of operations: The scale of operations is directly related to the working capital. Small-scale operations require less working capital, whereas large-scale operations need more working capital.

(ii) Business cycle: Again, business cycles and working capital are directly related to each other. During an economic boom, the demand for working capital is raised and thus higher sales are generated. However, during the recession, the demand for working capital contracts and lower sales are generated.

(iii) Availability of raw material: When raw material is easily available throughout the year, then less working capital is required. But if the supply of raw materials is not regular, then less working capital is required.

(iv) Production cycle: If the production cycle is long, then working capital held in the form of raw materials, semi-finished goods and inventories will be less. However, if the production cycle is short, then there will be a lesser requirement for working capital.

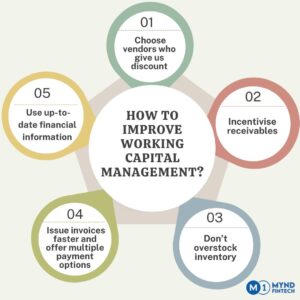

How to Improve Working Capital Management?

The best way to improve the working capital position is to collect receivables early and slow down the liabilities of payables. Let’s understand it deeply with the given points:

1. Choose vendors who give us discount: Maintain a good relationship with your vendor, so that when your company faces a cash flow crunch, you can gain discounts from vendors that will eventually help save finances.

2. Incentivise receivables: Plan to give incentives to the customers who pay on time. This will allow your debtors to take prompt action and prevent accounts from aging too much. Try not to transact business with customers who have a recorded history of defaulting.

3. Don’t overstock inventory: Always try to sell off finished goods as soon as possible. Don’t keep idle products in the warehouse.

4. Issue invoices faster and offer multiple payment options: Customers are not interested to pay off unless not are billed timely. So, it is important to send an invoice as soon as possible and allow recipients to pay the invoice on the spot, or either with a bank transfer and credit.

5. Use up-to-date financial information: Keep financial statements up-to-date. This will allow your company to have a clear picture of its financial position and will provide you with different avenues for improvement.

Working capital management solutions:

● Supply Chain Finance: It is a set of financial solutions that optimises cash flow by allowing businesses to lengthen their payment terms to the suppliers.

● Cash Management: Cash management is the process of managing cash flows. It helps maintain a decent level of liquidity and improves operational efficiency.

● Accounts Receivable Factoring: It is a form of financial management that allows businesses to receive immediate cash right after selling their receivables to a 3rd party, known as ‘factor.’ After the sale of receivables, the company receives immediate cash.

● Dynamic Discounting: Dynamic discounting is a solution that provides suppliers with the option to receive early payment in exchange for a discount on their invoice. This allows suppliers to access lower-cost funding than they would have otherwise received in order to invest in growth and innovation.

● Invoice Factoring: Invoice factoring is a financing process in which a business sells its unpaid invoices to a third-party financial lender, known as a factoring company in exchange for immediate cash.

● Vendor Finance: It is a form of lending in which a company lends moneyto be further used by the borrowers in order to buy the vendor’s products or property. It is usually in the form.

How Mynd Fintech can Help?

Mynd’s Fintech Vendor Finance Solution allows businesses to access short-term funding by selling their accounts receivable to us. This helps them free up working capital and improve their cash flows. Our flexible financing options are tailored to meet the unique needs of businesses so that you can focus on growing your business.

So, what are you waiting for? Optimise your working capital efficiently, send your query at Mynd and get the best deals.

FAQs:

Q1. What are the components of working capital?

Ans. Cash and cash equivalent accounts receivable, inventory and accounts payable are the components of working capital.

Q2. How do I calculate net working capital?

Ans. Net working capital = Current assets (minus cash) – Current liabilities (minus debt)

Q3. What are some common challenges in working capital management?

Ans. Poor inventory management, delays in payment to vendors, lack of formal structure and poor sales performance are some challenges in working capital management.

Q4. What is the relationship between working capital and cash cycle conversion?

Ans. Cash conversion cycle is a measure of how long cash is tied up in working capital. It considers the number of days a company takes to convert cash outflows into cash inflows.

Q5. What are the best practices for managing working capital effectively?

Ans. Automate vendor communication and vendor payments, improve receivables management and use real time analytics to manage working capital effectively.